Payment processing 101

By Nicole McDermott

If you’re wondering how to process debit and credit card payments online and in person for your small business, you’re not alone. Card transactions may seem as simple as a swipe or tap, but a lot happens behind the scenes. Beyond you and your customers, there’s a host of people and organizations that help transfer the money you’re owed to your business bank account.

Keep reading to learn important payment processing terms, how payment processing works, and the costs you may need to pay in order to process card payments.

Who are the important players in payment processing?

When it comes to processing payments, there are quite a few parties involved. Each entity plays a specific and important role, so before we explain how to process credit and debit cards, we’ll cover some helpful terms you should know.

- Cardholder

The person (consumer) who uses a credit card to make a purchase - Merchant

The person who offers items for purchase by consumers - Merchant service provider

The financial institution (typically a bank, independent sales organization, or cloud service provider) that does business with the merchant - Payment gateway

The technical service that connects a merchant’s website to payment networks in order to process a transaction - Card association

Sometimes called a payment card network, a card association is a group of banks or organizations that issue cards to cardholders and aid in transactions. In Canada, there are six card associations: American Express Canada®, Discover®, The Exchange®, Mastercard Canada®, Visa Canada®, and Interac®, a debit card network. - Payment processor

A company used by the merchant to access a payment card network - Payment processing agent

Also known as a credit card processing agent or a merchant services reseller, a payment processing agent is a firm or partner who works for a payment processing provider and sells its products and services to merchants. - Issuing bank

The financial institution that provided the cardholder with their card

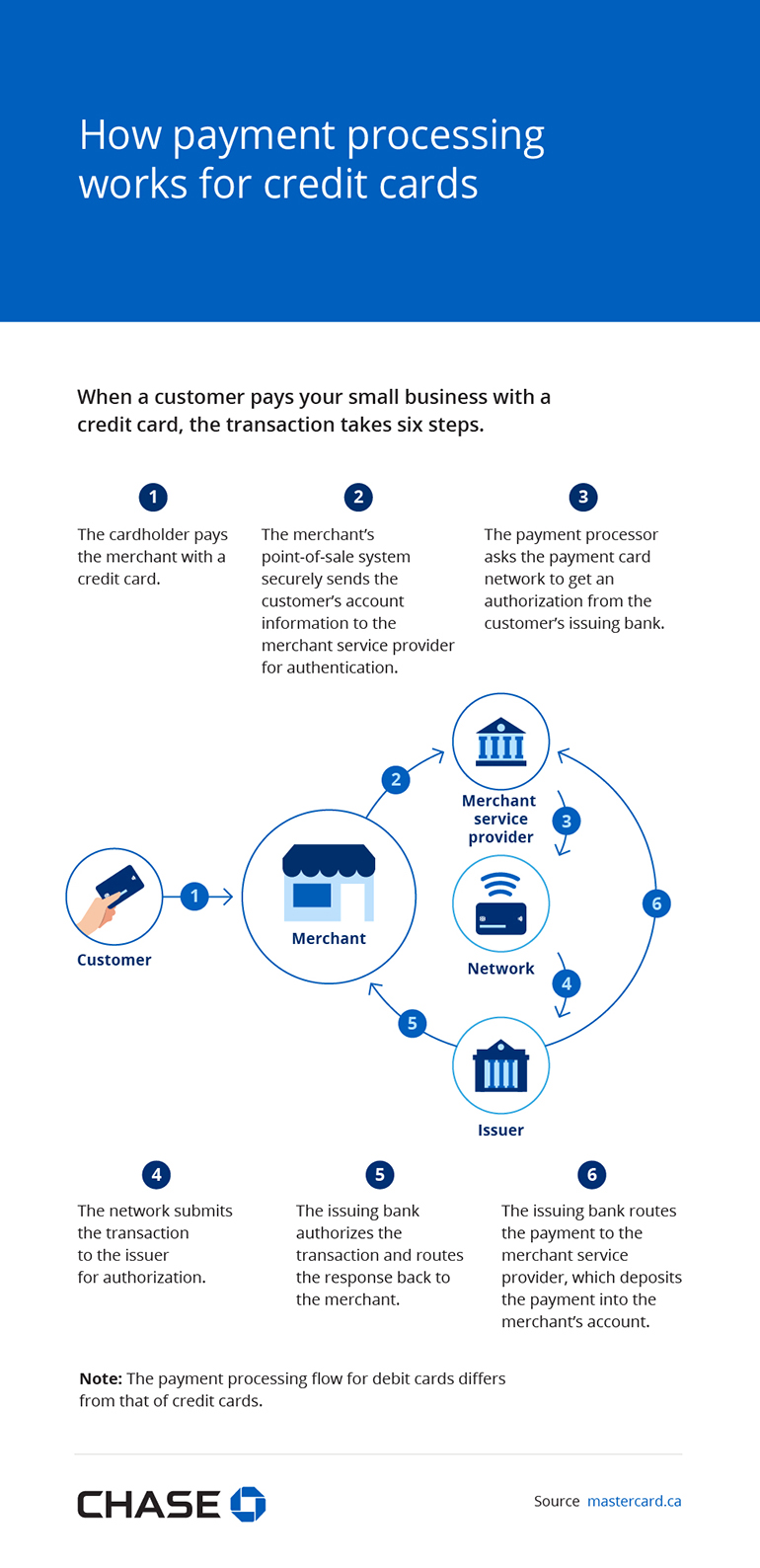

When a customer pays your small business with a credit card, the transaction takes six steps.

- The cardholder pays the merchant with a credit card.

- The merchant’s point-of-sale system securely sends the customer’s account information to the merchant service provider for authentication.

- The payment processor asks the payment card network to get an authorization from the customer’s issuing bank.

- The network submits the transaction to the issuer for authorization.

- The issuing bank authorizes the transaction and routes the response back to the merchant.

- The issuing bank routes the payment to the merchant service provider, which deposits the payment into the merchant’s account.

Note: The payment processing flow for debit cards differs from that of credit cards.

Sources:

What are the three primary parts of payment processing?

Each time a customer makes a purchase from you, called the point of purchase, a fairly complex series of electronic actions happen in order to complete the transaction. There are three key phases to this process: authorization, settlement, and funding.

Authorization

While the first step in processing a payment takes just seconds, it is an especially important one. You can’t accept the cardholder’s card without authorizing it — a consequence that could mean lost sales for you.

Authorization, which can be obtained via a point-of-sale terminal, e-commerce website, or phone, confirms two key pieces of information:

- The cardholder’s credit card number coincides with a valid account number.

- The cardholder has a sufficient credit balance to cover the transaction.

A card can then be approved, declined, or referred. If the card is approved, the transaction amount will be reserved from the cardholder’s available credit limit, you’ll receive an authorization number, and the transaction can move on to the next step. If it’s declined, the cardholder cannot use that card to complete the purchase. A card can be declined for many reasons, including when a credit limit has been exceeded or if the card was reported stolen.

The last response code, a referral, means there’s a request to the cardholder’s bank for further information. A referral can happen when a cardholder has reached their credit limit, if they use their card more than usual within a short timeframe, or when they swipe it outside of the country it was issued, among other cases. The cardholder will need to contact their issuing bank to resolve the issue or use a different card to complete the transaction.

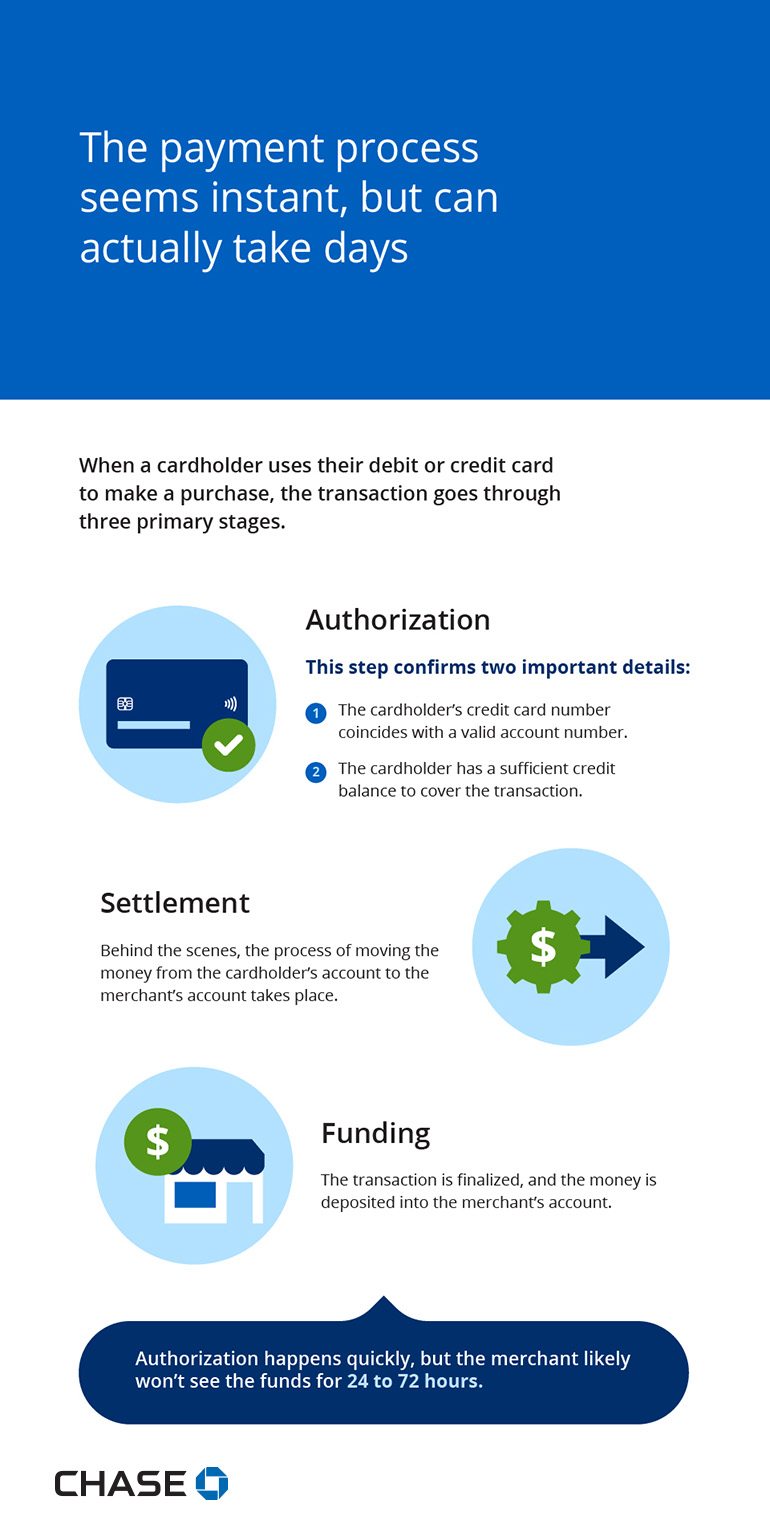

When a cardholder uses their debit or credit card to make a purchase, the transaction goes through three primary stages.

Authorization

This step confirms two important details:

- The cardholder’s credit card number coincides with a valid account number.

- The cardholder has a sufficient credit balance to cover the transaction.

Settlement

Behind the scenes, the process of moving the money from the cardholder’s account to the merchant’s account takes place.

Funding

The transaction is finalized, and the money is deposited into the merchant’s account.

Authorization happens quickly, but the merchant likely won’t see the funds for 24 to 72 hours.

Settlement

After the customer’s card is authorized — either in person, online, or over the phone — it's time to settle the payment to ensure it clears and that it’s funded. To do so, you need to present your transaction data to your bank. The bank then forwards the transaction requests to the payment brands, such as Visa® or Mastercard®, for clearing. After the issuing bank posts the transaction to the cardholder’s account, the cardholder will see it in their statement and pay their monthly bill.

Funding

The last and most straightforward step of payment processing is funding. This phase means the bank has deposited money from the processed transactions into your merchant account. Because it’s an extension of settlement, you may hear funding and settlement used synonymously.

How long do payments take to process?

When a customer makes a purchase at your store or on your website, it doesn’t mean the money is deposited in your business bank account on the spot the way it would have if the customer forked over a stack of bills. That’s because, depending on the card association involved in each transaction, it can take multiple business days to process payments, from the point of processing a sale to the moment you see funds in your bank account.

The credit card payment processing time can be impacted by weekends or non-banking days, since settlements do not take place on Sundays in Canada. You can choose daily or weekly funding, meaning your merchant bank will deposit processed funds every day or once a week.

How much does it cost to process payments?

With so many moving parts to payment processing, it’s no wonder merchants pay fees along the way. Credit cards are typically a more expensive payment method for merchants than cash and debit cards. However, because they’re a convenient, secure, and popular way for customers to pay for purchases, credit card processing is a necessary expense for most merchants.

Your small business is charged fees whenever a customer purchases a product or service from you. These fees vary depending on the cards you accept at your business (premium credit cards will impact you the most) and the financial institution associated with your merchant account. You may pay more for card payments made over the phone or online — these are known as card-not-present (CNP) transactions. Some merchants offset these costs by setting a minimum for credit card payments. Starting in October 2022, merchants will also be able to add a credit card surcharge, meaning customers who want to make a purchase with a card pay a portion of the processing fees.

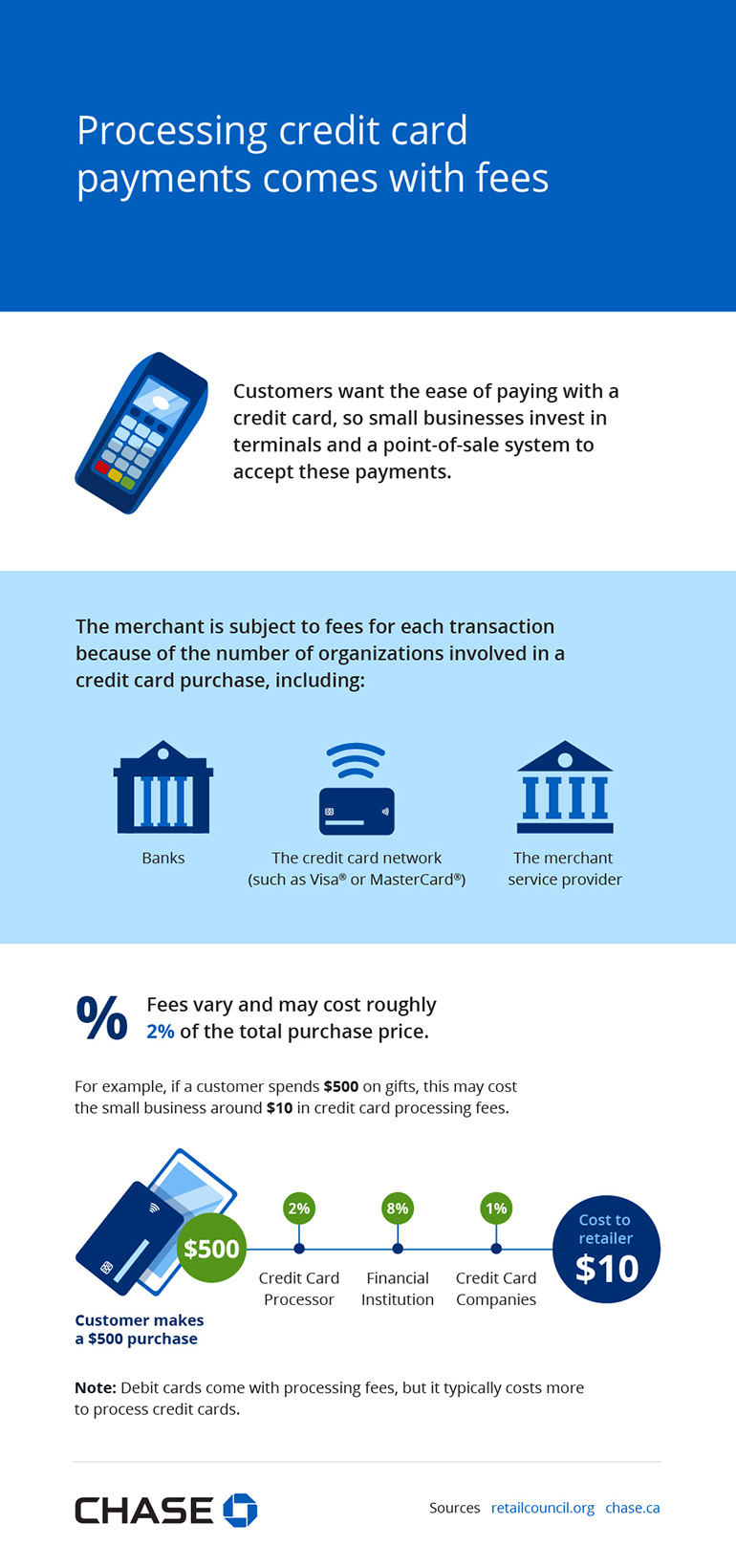

Customers want the ease of paying with a credit card, so small businesses invest in terminals and a point-of-sale system to accept these payments.

The merchant is subject to fees for each transaction because of the number of organizations involved in a credit card purchase, including:

- Banks

- The credit card network (such as Visa® or Mastercard®)

- The merchant service provider

% Fees vary and may cost roughly 2% of the total purchase price.

For example, if a customer spends $500 on gifts, this may cost the small business around $10 in credit card processing fees.

- Customer makes a $500 purchase

- $500

- Credit Card Processor

- 2%

- Financial Institution

- 8%

- Credit Card Companies

- 1%

- Cost to retailer

- $10

Note: Debit cards come with processing fees, but it typically costs more to process credit cards.

Sources:

While some of these fees can be negotiable when you first set up your merchant account, others are flat rates. These fees may include:

- Transactional fees paid to the banks, card associations, and processor

- Interchange fees paid to the card-issuing banks

- Terminal fees paid to the company that issued the terminal. This only applies to merchants with physical stores.

- Payment gateway fees paid to the e-commerce platform (though some service providers support card-present processing through their gateway)

- PCI fees paid to the Payment Card Industry (PCI)

- Negotiable monthly and annual fees

These fees can change over time. Your merchant account provider should communicate any upcoming fee changes to you by mail or email, so it’s important to keep an eye on those messages so you can stay on top of your payment processing costs.

Conclusion

As a small business owner, there’s a lot to keep track of when it comes to payment processing. By understanding the gist of what happens after a customer taps, chips, or swipes their card (or enters their card details online), you can get a better idea of how long payment processing takes and the fees you will incur by accepting credit cards. With that understanding under your belt, make sure to take the time to regularly check in on your payment processing strategy and make adjustments as you go.