Tap, chip, swipe: How in-store credit card payments work

By Nicole McDermott

Not so long ago, stores operated with the help of a sizable countertop cash register and customers paid with, well, cash. Now, accepting credit cards is the norm and it’s crucial for small businesses to not only offer an option for credit card transactions, but also to select the right payment solution for their in-store location based on cost, security, mobility, and more.

Read on to learn how the most common credit card processing methods work, plus important tips and strategies to consider in order to ensure efficient, secure payments for you and your customers.

The history of credit card payments

Credit cards have been around for nearly a century.

Manual card imprinting tools debuted in the late 1920s. They allowed vendors to make a copy of the card using carbon paper, which made an imprint of the embossed information on the card.

The process was slow, not secure, and had a host of issues. For example, after each transaction was processed, vendors had to find a way to securely file the copies in order to support against chargebacks and have proof of signature.

In the 1960s, a magnetic stripe was added to cards, and customers could swipe their cards in a terminal that read that stripe.

Chip cards, also known as EMV, became more mainstream in Canada in 2007. They were a more secure and faster way to pay.

Tap-to-pay cards are the latest technology for credit cards.

- These cards require proximity: no swiping the stripe or inserting the chip.

- Contactless payments and chip cards offer customers and vendors more security by encoding each transaction and making data more difficult to compromise.

Sources:

The origin story of credit card readers begins with the manual card imprinting tool. This tool, which debuted in the late 1920s, explains why all credit cards used to feature embossed characters. In other words, your name, account number, and the card’s expiration date would all be raised in order for a manual card imprinting tool to be able to copy it. While the credit card networks evolved — as the number of cardholders and locations who accepted credit increased — processing and keeping track of payments got pretty complicated. After a customer received their receipt, each and every merchant copy of the imprinted carbon sales slip needed to be deposited at the merchant’s bank on a daily basis.

The 1960s brought us the magnetic stripe, or “magstripe,” a major innovation that allowed merchants to shift credit card processing from manual to electronic. While this technology didn’t really take off until the ‘80s, it allowed customers to swipe their cards through a terminal — no carbon paper necessary. While cards still featured all the same important details, the stripe itself contained the information a vendor needed to validate the payment.

Chip cards became mainstream in 2007. A microchip stores a person’s encrypted credit card details and communicates with that person’s bank to validate the authorization of a transaction.

Next came tap-to-pay cards. This payment innovation allows customers to tap their contactless chip card, payment-enabled mobile wallet, or wearable device against a contactless terminal. While contactless payment technology emerged in the 1990s, Visa®, Mastercard®, and American Express® didn’t introduce the technology until 2008, and Interac Flash® debuted in 2011.

With the improvement of credit card tech, many businesses no longer use the swipe function on their terminals for credit cards. However, the feature is still helpful for businesses that use them to process loyalty cards, which customers can swipe in the terminal.

How credit card processing works

Before you invest in a new credit card reader, it’s helpful to understand the basics of processing credit card payments. There are three phases:

- Authorization

This step confirms that a person’s card number coincides with a valid account number and that there’s a sufficient credit balance to carry out a particular transaction. A card can then be approved, declined, or referred. A referral is a request by the cardholder’s bank for further information. - Settlement

After customers pay, a merchant must settle the payments to ensure they not only clear, but also that they’re funded. To carry out this step, a merchant needs to present approved transactions to their acquirer. Then, the bank submits the transactions to the payment brands — such as Mastercard® and Visa® — for clearing. - Funding

Next, the bank or the acquirer deposits money from the processed transactions into the merchant’s account. This step is often used interchangeably with the previous step because it’s an extension of the settlement phase.

Now let’s dive a little deeper into how the most common methods work, plus some pros and cons of each.

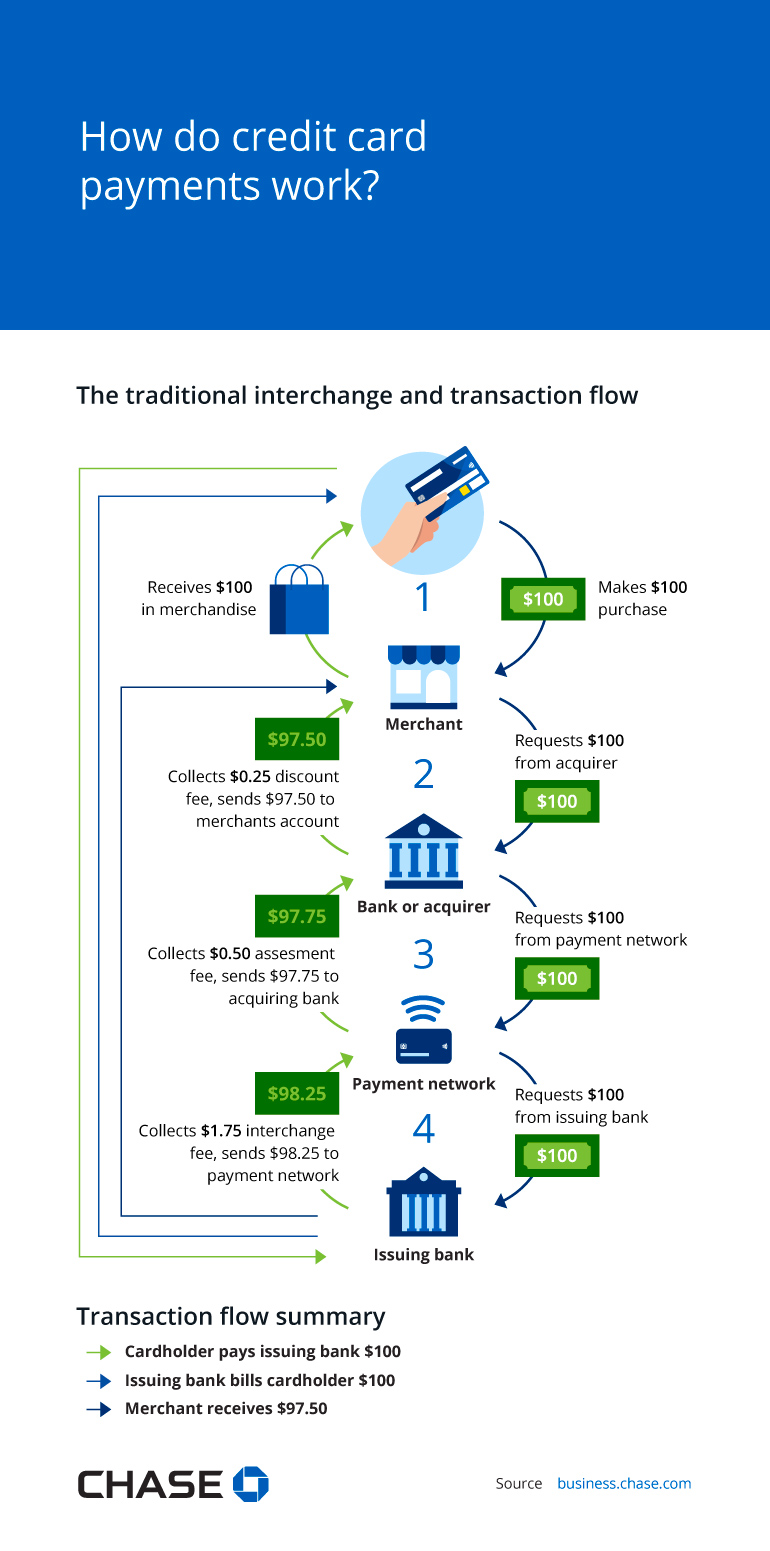

The traditional interchange and transaction flow

- Cardholder makes a $100 purchase

- Merchant requests $100 from acquirer

- Bank or acquirer requests $100 from payment network

- Payment network requests $100 from issuing bank

- Issuing bank collects $1.75 interchange fee, sends $98.25 to payment network

- Payment network collects $0.50 assessment fee, sends $97.75 to acquiring bank

- Bank or acquirer collects $0.25 discount fee, sends $97.50 to merchants account

- Cardholder receives $100 in merchandise

Transaction flow summary

- Cardholder pays issuing bank $100

- Issuing bank bills cardholder $100

- Merchant receives $97.50

Sources:

Chip and PIN

This option is also referred to as EMV because Europay®, Mastercard®, and Visa® introduced the global standard for cards equipped with chip technology. Chip and PIN cards have a smart chip that requires the customer to enter their personal identification number (PIN) for added security.

Cards with chips reduce fraud considerably for in-person purchases compared to magnetic-stripe-only cards because EMV cards contain an integrated circuit chip that encodes each transaction in a unique way. If the transaction data is stolen or compromised, it can’t be used a second time for a separate transaction. Meanwhile, magnetic stripes on cards are relatively easy to hack, and give the hacker the cardholder’s private information. That said, the security benefits of a chip transaction cannot be leveraged in card-not-present (or online) transactions.

In addition to more secure data, chip cards support a minimum of two cardholder verification methods (CVM), which help protect the cardholder against fraudulent charges if their card is lost or stolen. Three CVMs (PDF) you’re likely to encounter include offline PIN, online PIN, and signature verification.

- Offline PIN is the primary CVM in Canada. With this method, the PIN is verified offline by the EMV chip card

- An online PIN, on the other hand, is encrypted and verified by the card issuer online.

- Signature verification, when conducted properly, means the cashier compares the cardholder’s signature on the receipt against the signature on the back of their card to verify they match.

Tap to pay

Tap-to-pay cards come equipped with a microchip and a small radio frequency antenna that allows a customer to make a payment without having to enter a PIN or sign a receipt. Cardholders wave or tap their contactless-enabled payment method in close proximity to the terminal. Small businesses that have a POS system that accepts contactless payments appeal to customers who prefer to use digital wallets on their phones or smartwatches, too, as digital wallets use the same technology as tap-to-pay cards.

Contactless purchases made with a tap-to-pay card are typically reserved for transactions that are $250 or less (more costly purchases will require a customer to enter their PIN). Because tap-to-pay cards also use a unique, encrypted code for each transaction and transmit less information about a customer, they’re much more secure than their credit card predecessors. As new cards are created with tap-to-pay technology, we may also see more cards switch to vertical orientation rather than horizontal.

Three common categories of credit card readers and terminals:

- Mobile card readers

- Wireless terminals

- Traditional countertop terminals

Important factors to consider:

- Speed

- Security

- Cost

- Mobility

What to consider when you invest in credit card readers and terminals

The machines that process credit card payments today bear little resemblance to the early card imprinting machines. Now you’re likely to find three main categories of readers and terminals:

- Mobile card readers

These on-the-go solutions use a smartphone or tablet connected to Wi-Fi or a cellular data network and require an accompanying app to process transactions. - Wireless terminals

Restaurants can use these handheld terminals to process payments at the patron’s table using a 3G or Bluetooth connection to the POS system. - Traditional countertop terminals

These machines process transactions on one device with a wired point-of-sale system without the need for a smartphone, tablet, or computer.

Before you decide on a credit card system for your small business, it’s important to consider the following factors.

- Speed

Both the merchant and the customer are better served when each step finalizes quickly, which can be due to the machine, its software, or the credit card processor. - Security

Both chip and tap-to-pay cards improve security as magnetic stripes can be cloned easily. In fact, because it’s so challenging to duplicate a microchip, chip cards have cut down on counterfeiting fraud in Canada by 76% since they were introduced in 2008. And, as mentioned earlier, chip and tap-to-pay cards both use a unique, encrypted code for each transaction — plus they’re embedded with multiple layers of security. When a small business uses a terminal that accepts more secure transactions via chip and PIN and tap-to-pay cards, customers can make a payment knowing they’re less vulnerable to data breaches. - Cost

For merchants, there are costs associated with each payment method, which include the time spent counting and depositing cash. When it comes to credit cards, processing fees can add up, and it costs small businesses almost double (PDF) per transaction compared to large businesses. Make sure to research not only the upfront cost of your terminal contenders but also the processing fees, which can vary based on accepted payment options. - Mobility

For vendors that need the ability to meet customers in various locations, wireless and mobile card readers offer greater mobility (while taking up less space) over traditional countertop terminals.

Conclusion

As credit cards evolve, so too do the machines that process them. Microchips, digital wallets, and contactless payment will likely continue to take hold, encouraging merchants to opt for intuitive wireless readers with touchscreens.

After those become the new standards? Biometric authorization — meaning payments made via fingerprints, facial recognition, and iris scans — may become the new normal. By keeping an eye on payment technology and considering all the factors that influence your small business, you can choose the best payment solution for your needs.