Bill 72 support

Learn what Bill 72 means for your business and the steps you can take to stay compliant.

What is Bill 72?

Bill 72 is an act introduced by the Quebec government to help protect consumers by simplifying how contracts, pricing and tipping is presented to customers.

As it pertains to your business, the focus of this article is the requirement to allow tipping before tax on payment terminals.

What do I have to do to comply with Bill 72?

If your business operates in Quebec, you will need to ensure that all tips are calculated based on the pre-tax sales amount by no later than 7 May 2025.

What if I use an integrated payment solution?

If you use a terminal integration, please contact the vendor for additional support on how to comply.

Will my terminal be compliant to Bill 72?

If you have a Desk/5000, Move/5000 or Apex Wireless Terminal (DX8000), you will need to contact us to ensure your terminal is compliant.

If you have a newer-generation device, including the Wireless Terminal (DX8000) and Countertop Terminal (DX4000) with the Chase Payments application, you can configure the terminal yourself to be compliant.

Refer to your device below for next steps.

Action required

Desk/5000

If you use a Desk/5000, please give us a call at 1-800-265-5158 so we can help you set up your device to ensure you stay compliant.

Action required

Move/5000

If you use a Move/5000, please give us a call at 1-800-265-5158 so we can help you set up your device to ensure you stay compliant.

Action required

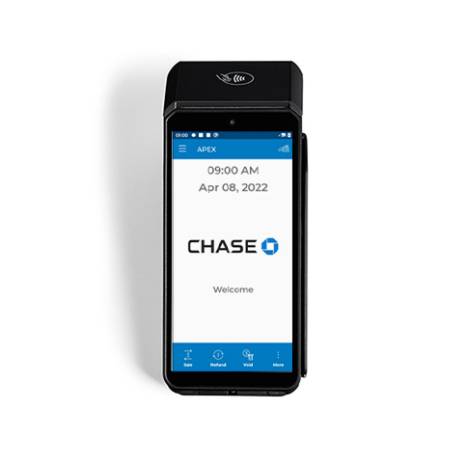

Apex Wireless Terminal (DX8000)

If you have an Apex device (look for “Apex” in the top corner of your terminal), please give us a call at 1-800-265-5158 so we can help you set up your device to ensure you stay compliant.

Action may be required

Wireless Terminal (DX8000)

If you use our typical Wireless Terminal (not Apex) with the Chase Payments application, you should be all set for compliance as long as you have tip prompting enabled for pre-tax tips. Follow the steps below to enable the functionality on your terminal:

- Choose the three lines/hamburger menu on the upper left of your screen

- Choose Settings

- Enter your Manager ID credentials, then press Confirm

- Choose System

- Choose Default Tax Percentage. Enter the desired tax amount and press Confirm

- Choose the back arrow in the upper left corner of your screen

- Choose Transactions

- Choose Tax Prompting

- Choose Required Entry and press Confirm

- Choose the back arrow to return

Action may be required

Countertop Terminal (DX4000)

If you use our Countertop Terminal (DX4000) with the Chase Payments application, you should be all set for compliance as long as you have tip prompting enabled for pre-tax tips. Follow the steps below to enable the functionality:

- Choose the three lines/hamburger menu on the upper left of your screen

- Choose Settings

- Enter your Manager ID credentials, then press Confirm

- Choose System

- Choose Default Tax Percentage. Enter the desired tax amount and press Confirm

- Choose the back arrow in the upper left corner of your screen

- Choose Transactions

- Choose Tax Prompting

- Choose Required Entry and press Confirm

- Choose the back arrow to return

Action required

Chase POS Terminal

If you use a Chase POS terminal, please give us a call at 1-800-265-5158 so we can help you set up your device to ensure you stay compliant.

Action required

Chase Mobile Checkout-PLUS

If you use the Chase Mobile Checkout-PLUS app, you’ll need to enable tip before tax to stay compliant with Bill 72. Here’s how to do it:

In your Merchant Portal:

- Navigate to Settings

- Choose Transaction Settings

- Go to Tip Calculation on the right side

- Click the dropdown menu and choose Calculate Tip Before Tax

- Press Save

In your Chase Mobile Checkout-PLUS app:

- Press the three lines/hamburger menu

- Go to Transaction Settings

- Press the dropdown menu under Tip Calculation

- Choose Calculate Tip Before Tax

- Choose Done and then Save