How contactless payment works and its benefits to businesses

By Amanda Reaume

Put simply, contactless payments are payment methods that don’t require a customer to insert (or swipe) their card through your payment device. Instead, all your customers need to do is hover their payment method near your card reader or tap to pay. With just a few simple moves, they can get on their way and you’re free to serve your next customer.

Contactless payment can also be particularly helpful for your employees, helping them move through long queues of customers at a rapid, yet effective, rate. This is because cardholders don't need to enter a PIN or sign any receipts when they perform these transactions. They just tap their card or phone, get visual confirmation that the payment is approved, and carry on with their day.

Below, we’ll walk you through the ins and outs of contactless payments and how they can benefit your business.

What is contactless payment?

Contactless payments include a few different motions, including when customers hover their chip card above your point-of-sale device, when they tap to pay by tapping the card on the device, or when they access their digital wallet by holding their mobile phone or smartwatch near your payment device.

Contactless payments work via a technology called near-field communication (NFC). It’s similar to the tech that allows things like digital key fobs to work. However, when it comes to contactless payments, NFC is far more secure, enabling mobile phones, tablets, smartwatches, and chipped payment cards to communicate with modern card readers on payment devices and point-of-sale devices.

According to Forbes writer, Tori Perkins-Southam, “Like the chips in our credit cards, the contactless card chip creates a one-time code for each individual transaction to accompany your payment information. This code is transmitted with your account number when you ‘tap’ to pay. Your name, billing address and card verification code aren’t transmitted.” A complex algorithm generates each one of these unique codes, confirming that “contactless credit cards are currently among the safest forms of payment.”

The Canadian government has also made this new form of payment less risky for merchants to adopt. The Code of Conduct for the Credit and Debit Card Industry in Canada has ensured that business owners can cancel payment acceptance for mobile wallets for 30 days without penalty if the fees increase in comparison to paying via contactless payment with a card present. Effectively, fees for processing NFC payments and mobile wallets usually remain the same as those for whatever underlying payment method the customer is using.

Types of contactless payment

Customers can use a few types of contactless payment methods, including:

Chip cards: You can process payment transactions on credit or debit cards via contactless technology if they’re enabled with radio frequency identification (RFID) chips. RFID chips are often visible on credit or debit cards, and customers can wave them over devices for quick, easy payments. To determine if the chip on a card is RFID-capable, look for an industry contactless symbol, which looks like sideways Wi-Fi bars, on the front of the card. The placement of the symbol varies by card issuer but it’s always on the front.

Mobile wallets: Smartphone users can set up a mobile wallet by adding their credit cards, debit cards, or other payment info to their devices. Then, even without their card physically present, they can wave their phone near a contactless payment reader to complete a transaction.

Smartwatches: Many smartwatches are NFC-enabled and allow users to pay by waving their watch near a contactless payment reader.

There are a few types of contactless payment methods customers can use.

These include:

- Mobile wallets

- Chip cards

- Smartwatches

How it works: POS and contactless payment

Canadians increasingly prefer more convenient payment methods. In a 2024 Interac® survey, 78% of Canadian Gen Z adults used their smartphones to pay for things.

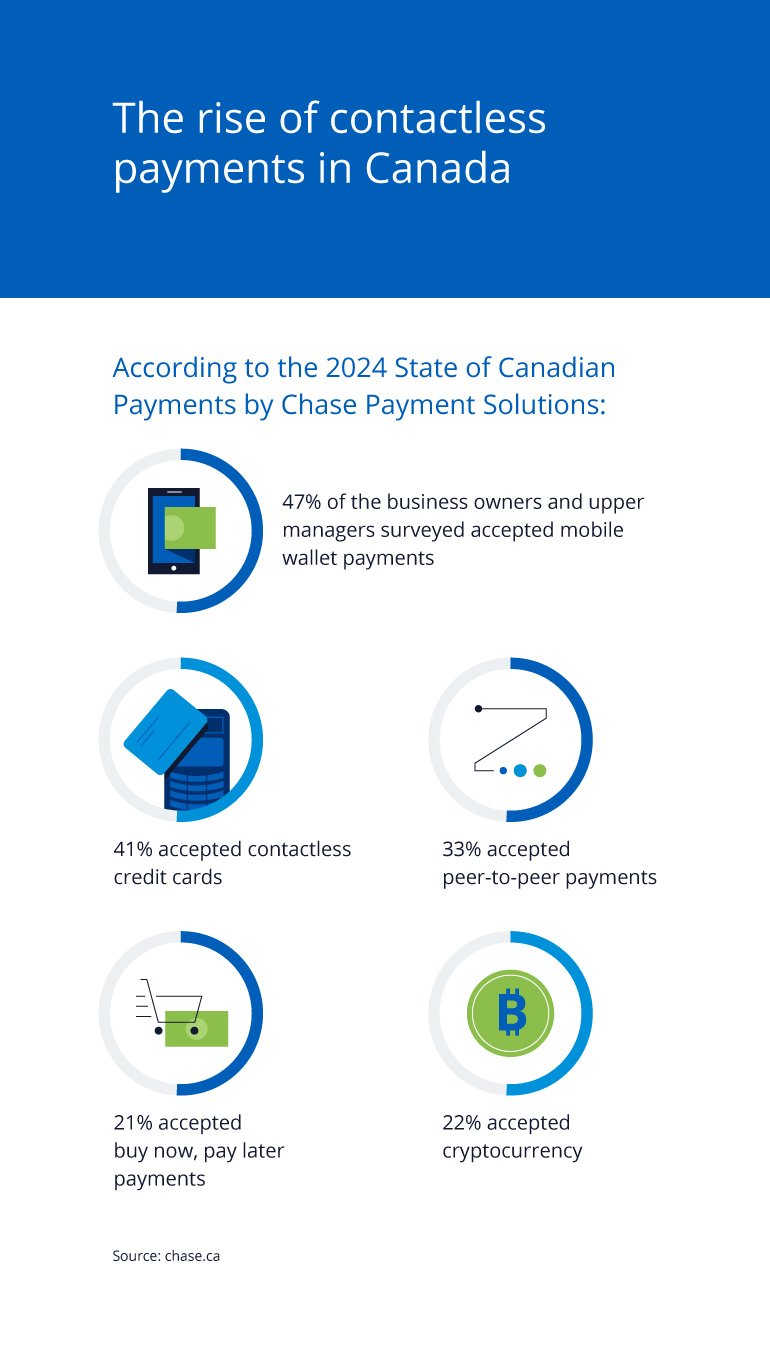

And businesses are offering more contactless options to meet customer demand. According to the 2024 State of Canadian Payments by Chase Payment Solutions, 47% of the business owners and upper managers surveyed accepted mobile wallet payments, 41% accepted contactless credit cards, 33% accepted peer-to-peer payments, 21% accepted buy now, pay later payments, and 22% accepted cryptocurrency.

Once you understand the inner workings of contactless payment methods, they become even more appealing.

Payment devices enabled with an NFC reader process contactless payments by detecting the presence of an NFC-enabled device and then safely accessing the payment information on it to process the transaction.

One of these safety measures is a tap limit. Many card companies put a limit on the dollar amount a quick tap payment can approve. If a payment exceeds that amount, the cardholder must verify their identity with a PIN.

Wondering if your business has these capabilities already? Take a look at your payment devices. Some older devices may require the addition of a separate NFC reader, but many newer devices come with readers already integrated into the system.

According to the 2024 State of Canadian Payments by Chase Payment Solutions:

- 47% of the business owners and upper managers surveyed accepted mobile wallet payments

- 41% accepted contactless credit cards

- 33% accepted peer-to-peer payments

- 21% accepted buy now, pay later payments

- 22% accepted cryptocurrency

Source:

How to use contactless payment

What does a contactless payment transaction look like? Here’s a breakdown of how it works on Chase’s POS devices:

- The merchant rings up a purchase and inputs the amount owed into their payment system, the same as any transaction.

- When prompted, the customer hovers their phone or smartwatch near the card reader or taps their NFC-enabled chip card on the device to pay. No PIN or signature is required unless the customer has exceeded the contactless limit.

- The reader accesses the payment information and processes the payment almost instantly.

- The payment device approves the transaction.

- The customer takes their goods and enjoys the rest of their day.

The best thing about contactless payments is that they’re extremely easy transactions to process and typically require no extra staff training.

Is it secure?

You might be wondering how secure contactless payments are, given that they happen over near-field wavelengths.

Contactless payment devices are encrypted and can only be deciphered by dedicated readers in close proximity. They are much safer than cash — which is more easily stolen and less traceable.

Additionally, the protections for users of contactless payments are the same as any other transaction made on their card. Many people use contactless payment methods because they’re faster, more sanitary (think about how many people touch cash or POS keypads), and far more convenient. Customers can simply wave their phone, watch, or card near your device rather than fumble to find and insert their card inside it. It’s a great payment option for people out on a run or those who want to grab a coffee or snack without bringing their wallet.

How contactless payments benefit businesses

Touchless payment options bring businesses many benefits:

- Faster service: Customers get in and out of your business faster, and you can serve more customers in a shorter amount of time.

- Convenience: Customers — especially those who are busy, have kids in tow, or are running a quick errand — love shopping at stores where they can get what they need quickly.

- No need to turn customers away: These days, more customers expect businesses to accept contactless payments. If a customer comes into your business with just their smartwatch and expects to pay via mobile wallet, you want to be prepared.

- Security: Contactless payments are more secure than cash and just as secure as contact chip card transactions. By offering more digital payment options, you give your customers a safer way to make purchases while reducing the cash you have on hand.

Contactless or touchless payments are becoming more common, and customers increasingly expect merchants to offer them.

Benefits for business owners include:

- Faster service

Your business can serve more customers in a shorter amount of time. - Convenience

Customers love shopping at stores where they can get what they need quickly. - No need to turn customers away

Customers pay the way they want. - Security

Contactless payments are safer than cash.

Source:

Conclusion

Contactless or touchless payments are becoming more common, and many customers expect merchants to offer them. They’re convenient and safe and indicate an increasingly popular payment preference by the Canadian public.

What’s more, they help you, as a business owner, deal more efficiently with customers during busy periods, and they may cost no more than your standard credit card processing. If your business isn’t on board yet, it may be time to offer your customers contactless payments.