How to register your small business in Ontario or Alberta

By Jackie Lam

Have you been itching to set your small business in motion? Maybe you’re ready to act on your dreams of opening a bakery. Or perhaps you've completed your massage therapy certification and want to formalize your services.

Across industries, new small businesses are sprouting up in Alberta and Ontario. In both Ontario and Alberta, there were more than 120,000 active businesses in business sector industries in 2023, with roughly 6,000 new businesses opening each month.

If you plan to open a business in either province, you'll need to register your small business. This allows you to claim your business name. It also provides proof that you're using the name for your company, which offers credibility.

In this guide, we'll walk you through the information you'll need to register a business in either province, the steps to take, and special considerations that you'll want to keep in mind.

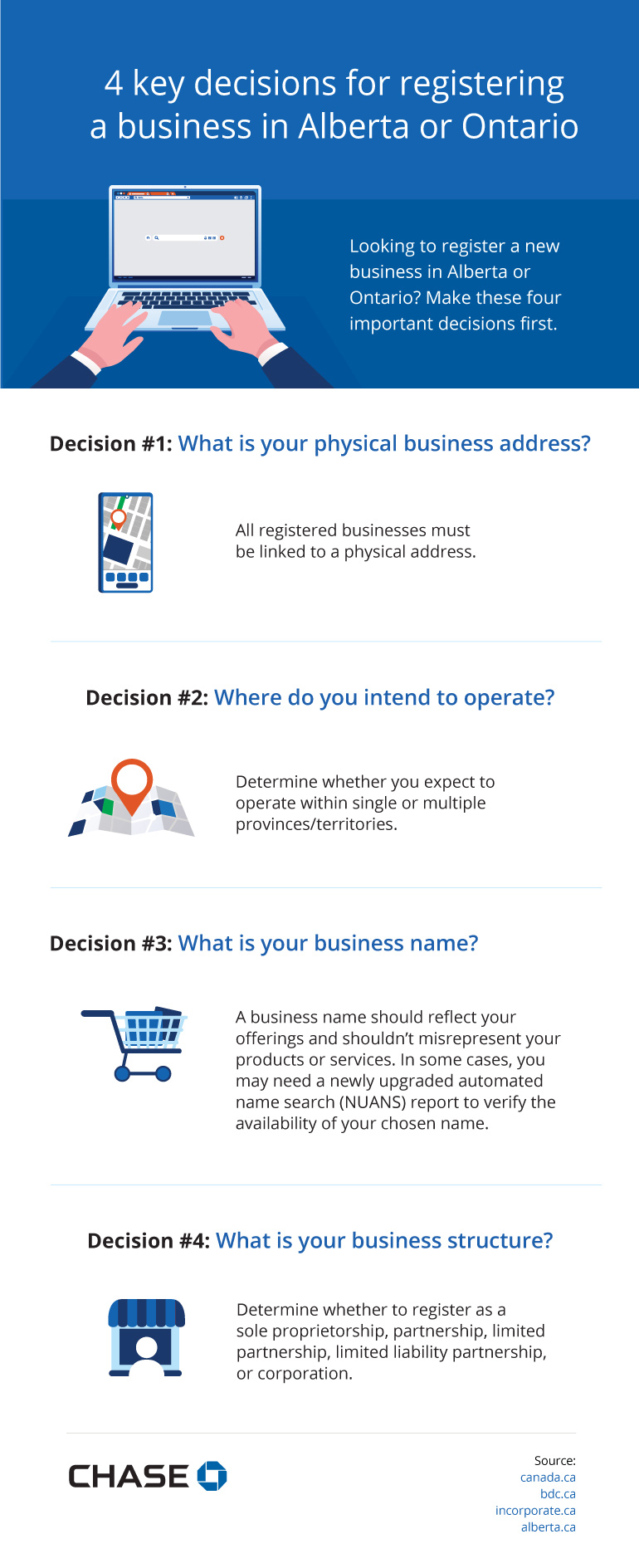

4 key decisions for registering a business in Alberta or Ontario

Looking to register a new business in Alberta or Ontario? Make these four important decisions first.

- Decision #1: What is your physical business address?

All registered businesses must be linked to a physical address. - Decision #2: Where do you intend to operate?

Determine whether you expect to operate within single or multiple provinces/territories. - Decision #3: What is your business name?

A business name should reflect your offerings and shouldn’t misrepresent your products or services In some cases, you may need a newly upgraded automated name search (NUANS) report to verify the availability of your chosen name. - Decision #4: What is your business structure?

Determine whether to register as a sole proprietorship, partnership, limited partnership, limited liability partnership, or corporation.

Sources:

- Change a business address (2023, November 30). Government of Canada.

- How to name a company. BDC.

- Sole proprietorship (2022, April 28). Government of Canada.

- Partnership (2023, June 20). Government of Canada.

- Limited partnership. BDC.

- Partnership Structures. Incorporate.ca.

- Incorporate an Alberta corporation. Government of Alberta.

Information you’ll need for registration

Whether you’re registering a business in Alberta or Ontario, you’ll need to determine the following information:

Business location

A physical address for your office is required when you register your business. (Even if you have an online business and/or operate out of a home office, you still need to give a physical address.) You can’t use rural routes or a P.O. Box as your legal business office. However, you can set up a virtual business address or office agreement to protect your privacy.

Areas of operation

Will your business operate within single or multiple provinces/territories? You might need to file additional forms depending on where you plan to do business.

For example, let's say you run a limited partnership or limited liability partnership in British Columbia, Manitoba, or Saskatchewan, and now you want to do business in Alberta. In that case, you’ll need to apply through Alberta’s online extra-provincial portal.

Business name

Make sure your name accurately represents your business and its offerings. If you’re operating a sole proprietorship or partnership in Alberta, your business name doesn’t have to be unique (meaning other businesses might operate under the same name), though another business with the same name may challenge you legally. If your business is in Ontario, the name does need to be unique.

You can request a business name report for Alberta or Ontario. This helps you see if there are any registered businesses, trademarks, or corporation names that are similar to the one you had in mind. You can also do a search through a Nuans authorized service provider (which is optional except for corporations).

When you want to register your business, you'll need to have the following information ready:

- Business name

- Business name report

- Valid form of ID

- Fee payment

Business type

Will you set up your business as a sole proprietorship, partnership, limited partnership, or limited liability partnership? To help you decide, let's go over the basics of each type of business entity and their pros and cons.

Sole proprietorship

A sole proprietorship is an unincorporated business owned by a single (or “sole”) person. It can operate under the owner’s name or a different business name. The owner is completely in charge of business decisions and is not considered separate from the business, legally speaking. This means they receive all profits and are responsible for all losses and risks.

Pros

- Easiest and least expensive business entity to set up and dissolve

- Offers privacy

- Most flexible of any business type

- Owner has complete control of the business

Cons

- No liability protection

- Owner is responsible for all debts, even if paying them off requires dipping into personal assets

- Higher personal tax rate

- Business can't continue if owner is absent

Partnership

In a nutshell, a partnership consists of at least two individuals, corporations, partnerships or trusts doing business together. The partners share in the company’s profits and losses, which are divided based on an agreement between them.

Pros

- Easy to create (even a verbal agreement will suffice)

- All partners share in the profits

- Can position company to be sold at some point (though selling can be complicated, depending on each partner’s stake)

- Easier to raise capital compared to a sole proprietorship

Cons

- All partners share in the risks and debts

- No liability protection

- Profits are taxed at individual partners' personal income rate, which can be higher than a corporate tax rate

- Because partners must collaborate on decisions, reaching a consensus can be tedious

Limited partnership

A limited partnership is made up of one general partner and one or more limited partners. Each partner has different rights and roles. For instance, the general partner takes a bigger share of the earnings — and they also contribute more capital and shoulder more risk. Limited partners also contribute some capital to the business, but they have less liability and not as much of a say in management decisions.

Pros

- Simple to form

- Key decisions are made by the general partner

- Offers tax benefits (e.g., losses can be deducted from personal income)

- Liability limits for limited partners

Cons

- Profits are taxed at individual partners' personal income rate, which is usually higher than corporate tax rates

- Unlimited liability for general partners

Limited liability partnership

A limited liability partnership is similar to a limited partnership and is usually made up of partners in an eligible profession, such as law or dentistry. One key difference is that all partners — including general partners — have liability protection.

Pros

- Partners are not liable for wrongdoing, negligence, or misconduct of a partner or employee

- Flexibility in business ownership

Cons

- More complex tax considerations

- Partners need to consult with each other on major decisions, which can slow down decision-making

- Some limits on tax deductions

Corporation

A corporation is a new distinct legal entity with rights and responsibilities. Incorporation comes with certain benefits and shields the owner’s personal assets (with some exceptions).

Pros

- The company is distinct from the people involved in it and exists as they come and go

- Liability limits

- Lower tax rates

- Easier to raise capital than a sole proprietorship

Cons

- Incorporation is costly

- Requires more paperwork; for example, minutes for all meetings

- Requires a separate business tax filing

Small business structures in Canada

When you’re starting a small business in Canada, determining a business structure is one of the first and most important decisions you’ll make.

Sole proprietorship

Small business owners generally choose a sole proprietorship when they are operating the business individually (i.e., they don’t have any partners) and want a simple business structure.

Partnership

Business owners choose a partnership when two or more individuals, partnerships, corporations, or trusts enter into the business with each other based on a shared agreement. These partners share equally in the benefits and risks associated with running the business.

Limited partnership

A limited partnership consists of both a general partner and a limited partner (or multiple limited partners). Each partner type incurs different obligations and rights.

Limited liability partnership (LLP)

A limited liability partnership is similar to a limited partnership in that it designates a general partner and limited partners. As its name implies, this structure differs from a limited partnership by restricting liability for all partners.

Corporation

A corporation is a new distinct legal entity with rights and responsibilities. Incorporating comes with certain benefits and shields the owner’s personal assets.

Sources:

- Sole proprietorship (2022, April 28). Government of Canada.

- Partnership (2023, June 20). Government of Canada.

- What is a limited partnership. BDC.

- Partnership Structures. Incorporate.ca.

- Limited liability partnership (LLP). Thomson Reuters Practical Law.

- Incorporation Pros and Cons. IncorporationOntario.ca.

Registering a business in Ontario

While registering a business in Ontario is much the same as elsewhere in Canada, there are specific resources available for those looking to set up shop here. There are also a few special considerations to keep in mind.

For instance, you can order a Business Names Report that is specific to Ontario. This will allow you to see if any other businesses are already operating under the name you'd like to use. Remember, business names in Ontario need to be unique.

You'll need to register your business via a different portal depending on which business structure you choose. There are different costs associated with each structure, ranging from $60 to $300. The following business structures are allowed in Ontario:

- Sole proprietorship

- General partnership

- Limited partnership

- Limited liability partnership

- Extra-provincial limited liability partnership, which is a limited liability partnership that was previously formed under the laws of another province

- Business corporation, or a legally established business that can own assets and take on debt separately from its owners

Accounts, identification numbers, and licences

You’ll need to obtain the following accounts, licences, and identification numbers to operate a small business in Ontario:

ServiceOntario

The business services section of ServiceOntario allows you to register a business name or start or dissolve a corporation.

Ontario Business Identification Number

Once you've registered, you'll receive a 9-digit Ontario Business Identification Number (BIN) from ServiceOntario, which is needed to do the following:

- Incorporate

- Create an import/export account

- Register for a Canada Revenue Agency (CRA) account

A BIN is used to identify provincial business registration. It’s different from a business number (BN), which is the number you will get from the CRA for tax identification purposes.

Business licences and permits

Depending on municipal, provincial, or federal regulations for your industry, you may need to obtain additional licences and permits. You can use BizPal, a free online tool, to do a search and help you figure out which permits and licences you need to operate your small business.

Taxes

Tax obligations are a big part of running any small business. If your small business in Ontario earns more than $30,000 in gross sales in a quarter or for four consecutive prior quarters before that, then you're legally obligated to register for a Goods and Services Tax/Harmonized Sales Tax (GST/HST) account and collect sales tax. You'll also need to report your personal income and make annual contributions to the Canada Pension Plan (CPP).

Regulations

In Ontario, certain regulations may apply to your business. It’s important to familiarize yourself with these rules, which include the following:

- Accessibility, or regulations and rules that pertain to removing barriers for those living with disabilities.

- Employment standards, which detail your obligations as an employer under the Employment Standards Act (ESA).

- Workplace health and safety rules, as determined by the Occupational Health and Safety Act.

Registering a business in Alberta

Registering a business in Alberta is much the same as Ontario in terms of researching your business name, filing an application, and paying a registration fee. That said, there are some particulars.

Naming rules

In Alberta, you can’t use certain words in your small business name. That’s because these names imply that your business is legally a corporation. They include the following:

- Limited (or Ltd.)

- Incorporated (or Inc.)

- Corporation (or Corp.)

If you are registering as a formal limited liability partnership (LLP), you are required to use one of the following terms in your business name.

- For English business names: Limited liability partnership (or LLP)

- For French business names: Société à Responsabilité Limitée (or SARL)

One thing to keep in mind: When you register your business name, it doesn't give you ownership of that name. It simply means you can use the name for your small business. If another business already owns the name, its owners could sue you over it. It’s a good idea to choose a name no one else is using.

Special forms depending on business type

You will need to submit a different form depending on your chosen business type.

- For a sole proprietorship, you'll need to submit a Declaration of Trade Name.

- For a partnership, you'll need to submit a Declaration of Partnership and, in some cases, a Special Authority to Execute a Declaration.

- For a limited partnership, you'll need to submit an Application for Alberta/Extra-Provincial Limited Partnership and a Special Authority to Execute a Declaration.

- For a limited liability partnership, you'll need to submit an Application for Alberta/Extra-Provincial Limited Partnership.

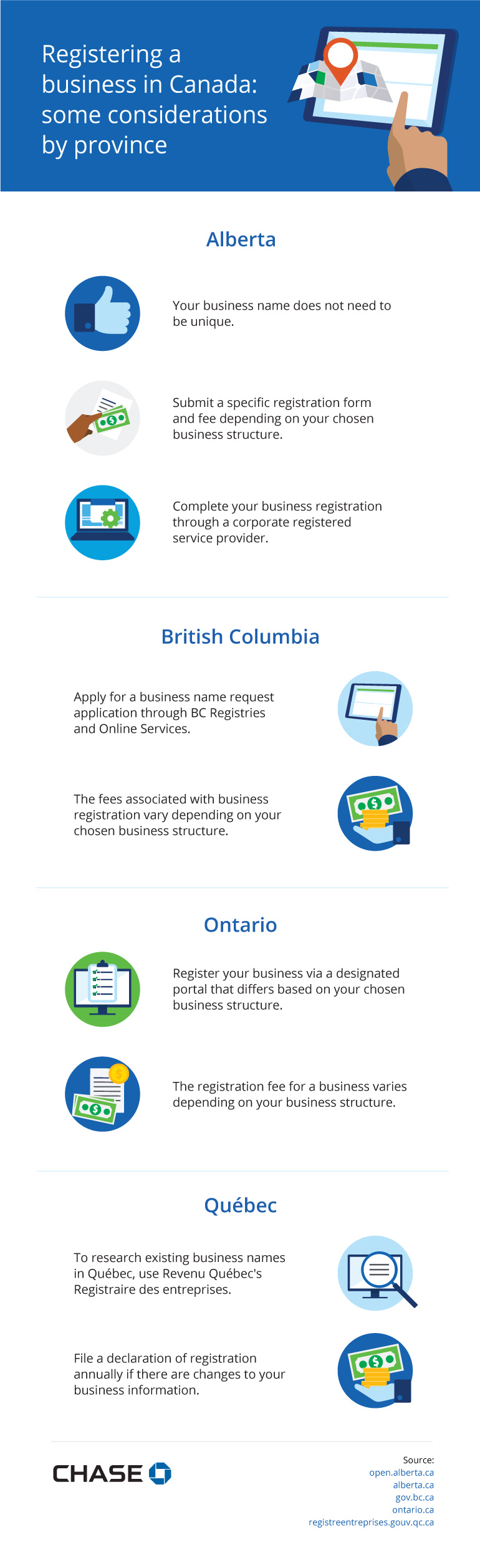

Alberta

- Your business name does not need to be unique.

- Submit a specific registration form and fee depending on your chosen business structure.

- Complete your business registration through a corporate registered service provider.

British Columbia

- Apply for a business name request application through BC Registries and Online Services.

- The fees associated with business registration vary depending on your chosen business structure.

Ontario

- Register your business via a designated portal that differs based on your chosen business structure.

- The registration fee for a business varies depending on your business structure.

Québec

- To research existing business names in Québec, use Revenu Québec's Registraire des entreprises.

- File a declaration of registration annually if there are changes to your business information.

Sources:

- Licensing and registering your business (2022, October 1). Government of Alberta.

- Register a business name. Government of Alberta.

- BC Registries and Online Services. Government of British Columbia.

- Forms, fees and information packages. Government of British Columbia.

- Register your business online. Government of Ontario.

- Check if you need licences and permits. Government of Ontario.

- Register and Constitute an Enterprise (2023, September 7). Gouvernement du Québec.

Considerations for your province

If you'd like to register your company in another province besides Alberta or Ontario, there may be additional requirements. Be sure to check official documentation and do your homework on government websites. Below, we’ve provided a brief overview of special considerations for Québec and British Columbia.

Québec

If you want to register your business in Québec, you can do so through Revenu Québec's Registraire des entreprises. You'll need to file a declaration of registration if any of the following applies to your business:

- You operate your business under a name that's not your legal first and last name (e.g., Dottie’s Donuts versus Dottie Little).

- You operate a tobacco retail outlet or tanning salon.

- Your business is not constituted in Québec, but you maintain your home in the province.

- You operate a general or limited partnership.

- Your partnership isn't constituted in Québec, but you have a business in the province.

- You need syndicates of co-ownership.

The fees associated with filing a declaration of registration in Québec vary according to your business entity.

Once you've registered your business, you must file an updated declaration along with your income tax return each year if there are changes to your business information.

British Columbia

To conduct a business name search for British Columbia, you can use the Names Registry database. To look up existing trademarks, you can use the Canadian Trademarks Database.

The next step is to apply for a business name request application through BC Registries and Online Services. Once your request has been approved, you can find more information on how to register your small business with BC Registries and Online Services.

The forms you need to complete will depend on your business structure. Note that registration fees vary depending on your business entity. For instance, if you have a sole proprietorship or general partnership in BC, there's a basic fee of $40 and a name approval fee of $30, for a total of $70. You can learn more about forms and fees for your business type on the British Columbia government page.

Once you receive your Business Number (BN) for your British Columbia-based business, you can use it to:

- Pay taxes.

- Contribute Canada Pension Plan (CPP) premiums.

- Make WorkSafeBC payments.

Grow your business with Chase

No matter which province you operate in, registering your business will require some paperwork. Understanding the nuances involved can make for a smoother process and help you best prepare to set up your business.

Registration is just the start of business ownership. Boost your knowledge about small business ownership and entrepreneurialism with our educational resources, which include information on fraud prevention, grants and resources, work-life balance, how to take payments, and more. Starting a business is both exciting and a little daunting, and you don’t need to do it alone.