Enterprise payment solutions

If you're one of the more than 3,000 large businesses in Canada with at least 500 employees, you know some of your criteria for choosing a payment provider aren’t the same as for small- or medium-sized businesses. With a higher average volume of transactions and a greater number of locations than smaller companies, enterprise companies typically face more complex business operations.

So how do you know what to look for? While wading through the morass of enterprise payment platform options can be a tall order, we’re here to help with a comprehensive overview of features and capabilities to consider. But first, let’s examine what enterprise payment processing is.

What is enterprise payment processing?

Also known as enterprise payment systems (EPS), enterprise payment processing includes payment platforms that offer features, functionalities, and systems geared toward larger businesses with a more robust volume of transactions and multiple (sometimes global) locations.

Smaller businesses typically use point-of-sale (POS) systems designed for card or cash transactions and a single e-commerce or brick-and-mortar location — or a combination of both. Small businesses have a lower volume of transactions, generate fewer profits, and have only a few main sources for their cash flow.

For instance, an independent coffee shop will make the majority of its sales from customers who patronize the store and from online merchandise sales.

Enterprise payment processing, however, can support different types of payments, including global payments, online payments, wire transfers, and electronic funds transfers (EFTs). It can also handle both one-off and recurring billing and provide tools for reporting and analytics.

Ultimately, you’ll want to work with an enterprise payment provider that can help you offer the right solutions for your customers, streamline processes, and provide useful analytics and data. These capabilities can reduce costs, smooth out inefficiencies, and help your business reach your short- and long-term goals.

Virtual kiosks

- What they are: Payments via self-service, AI-powered digital interfaces

- Why they’re important for enterprise: They can handle a high volume of transactions in industries like retail, real estate, and automotive to reduce the need for in-person assistance.

- What the data shows: 41% of Canadian businesses would like to offer virtual kiosks.

Augmented reality apps

- What they are: Apps that enhance the customer experience by allowing customers to visualize or interact with products

- Why they’re important for enterprise: They offer interactive, immersive customer experiences to drive sales and retain customers in competitive environments.

- What the data shows: 44% of Canadian businesses would like to offer an augmented reality app

Source:

How to choose an enterprise business payment solution

Payment transactions in Canada remain high. According to a 2023 Payments Canada report (PDF), Canadians made 20.5 billion payment transactions totaling $11.7 trillion the year prior. Additionally, transaction values and volumes across all payment types (except cheques) saw year-over-year increases. Chase processes over $10 trillion in annual debit and credit volume worldwide.

Payment processes, preferences, and technology will continue to evolve. As an enterprise business, you'll want to pick a payment solution that offers the features, functionality, capacity, and solutions to help you scale and pivot accordingly.

While the exact criteria will depend on the needs of your business, here's what to look for in an enterprise business payment solution:

Capabilities

The features and functionality of the payment processor you choose need to match your needs and how you do business. For instance, if you run an international business with global locations that require your payment provider to process transactions in different currencies, make sure the provider you get offers this capability. And if you operate a mainly online business or mostly physical storefronts, ensure your provider best suits where you are.

Navigation and ease of use

Look for a well-designed interface that makes it easy to search for information and creates reports based on analytics.

Scalability

Consider an enterprise payments solution with the capability, products, and resources to help you grow. Beyond your current needs, do your homework and explore the provider's other offerings that you may want to tap into in the future.

Pricing

Examine contracts for minimum time commitments. If you need to cancel before a contract expires, find out if you’ll need to pay a cancellation fee. When comparing packages, consider not only your per-employee and per-company monthly costs, but also any startup fees.

Innovation

The payments industry changes quickly. Look for a company leading the way in innovations such as blockchain technology, in-car payments, and advanced fraud prevention. Innovations like these set top vendors apart and can help your enterprise business stay competitive.

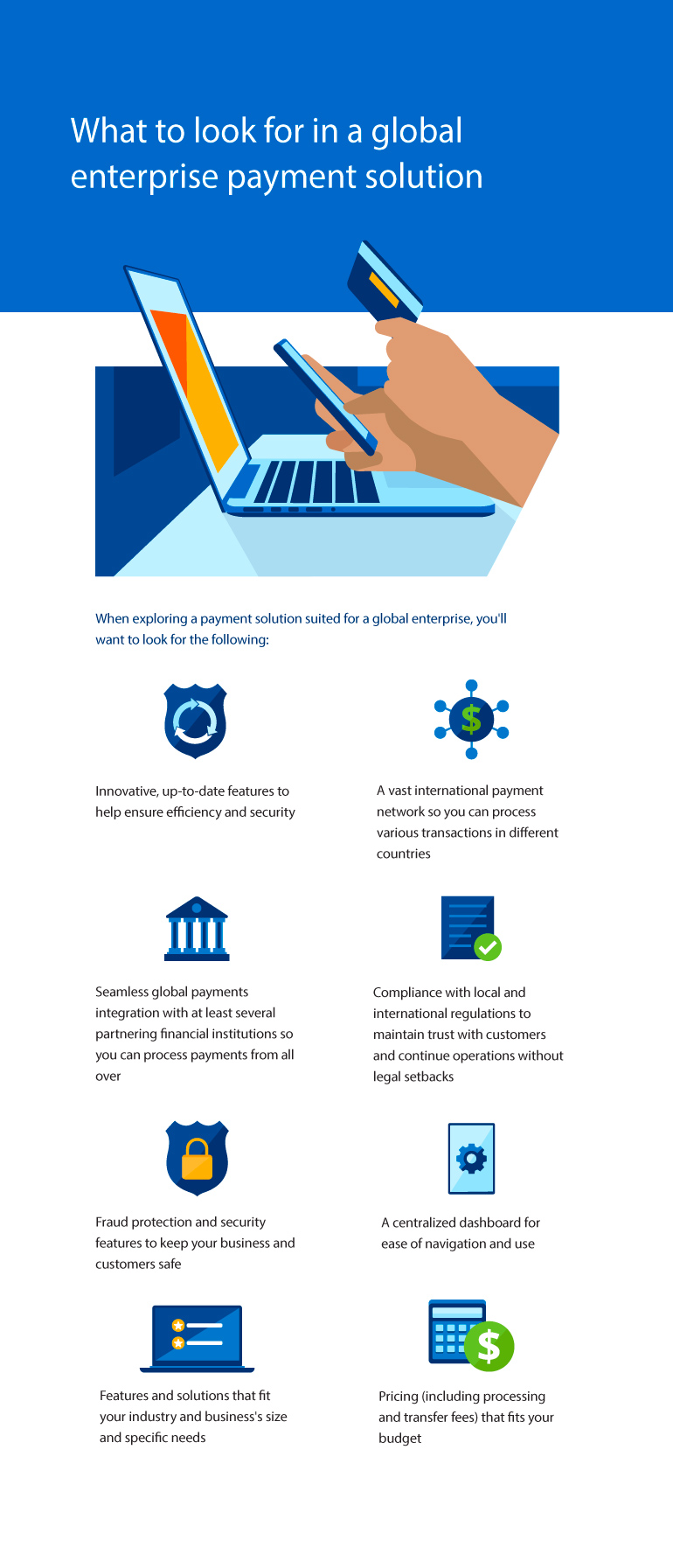

When exploring a payment solution suited for a global enterprise, you'll want to look for the following:

- Innovative, up-to-date features to help ensure efficiency and security

- A vast international payment network so you can process various transactions in different countries

- Seamless global payments integration with at least several partnering financial institutions so you can process payments from all over

- Compliance with local and international regulations to maintain trust with customers and continue operations without legal setbacks

- Fraud protection and security features to keep your business and customers safe

- A centralized dashboard for ease of navigation and use

- Features and solutions that fit your industry and business's size and specific needs

- Pricing (including processing and transfer fees) that fits your budget

Types of enterprise payment methods

Depending on your business, you might want to accept different payment methods. Thinking big picture can help you figure out how different payment methods fit into your enterprise payment strategy. Consider what is most beneficial and cost-efficient for your company, what trends are occurring in the payment space, and how different payment methods will affect the unique aspects of your business.

Large companies typically offer greater flexibility and a wider variety of payment methods for customers, vendors, and merchants. Let's look at the different types of enterprise payment methods:

- Cash

Long gone are the days when cash was king. While cash-based transactions have dipped dramatically — down to roughly 1 in 10 Canadian transactions — there’s still a demand for it. - Credit or debit card

Card processing is largely here to stay and makes up Canada's highest volume of transactions. - Cheques

While their use is on the decline, cheques may still come in handy for your business, especially if you're in the housing rental or construction industries. - Contactless payments

As you might expect, contactless payments by card and smart device are rising in popularity. - Electronic funds transfer (EFT)

EFTs, which are transactions made through a personal or business account from a financial institution operating out of Canada, have seen an increase in transaction value (PDF) in recent years. - Online transfers

Whether you have brick-and-mortar locations or not, electronic transactions may be an integral part of your business operations. - Wire transfer

Wire transfers are a convenient way to send and receive payments electronically, especially for global businesses. - Cryptocurrency and other digital currencies

While interest in digital currencies among Canadians is relatively low, your business might be curious about accepting digital currencies as payment.

While small, medium, and large businesses can accept many of the same payment types, some methods may differ. For instance, some enterprises may accept cryptocurrency and wire transfers while small businesses will not.

Should you consider an enterprise payments platform?

Payment solutions built for enterprises offer all the tools and capabilities to scale with agile platform-enabled payments. Here are some of the key features that could make an enterprise payments platform a worthwhile investment:

- Integration with other tools, including ERP systems

An enterprise payments platform can integrate with business tools like an enterprise resource planning (ERP) system, which can help you manage core processes and boost performance and efficiency. - Security and compliance

In an age of rising cyber threats, an enterprise payment provider needs advanced security and compliance features — like encryption and tokenization — to protect sensitive data and ward off fraud and cyber attacks. - Global capabilities

Even if you’re not global — yet — it’s a good idea to opt for an option that can streamline the payment process in different currencies in the event that you expand.

The solid blue arrows represent the flow of global payments. The dashed green arrows represent the checks completed by each entity against the previous step.

- Cardholder in Canada

- Merchant in the U.S.

- Merchant account and gateway (security check icon above)

- Acquiring financial institution and processor in the U.S.

- Card networks (security check icon above)

- Issuing bank in the E.U. (security check icon above)

Conclusion

Working with an enterprise payment provider can be a valuable investment that not only meets your payment processing needs, but also offers support as you grow and evolve your business.

As a global leader in payments, Chase offers flexible payment solutions for businesses of all sizes. To date, we’ve helped more than 110,000 Canadian business locations with their payment solutions. Contact us to find the right payment solution for you.