How to take online payments

By Lee Huffman

Customers increasingly make online purchases, which is accelerating the need for Canadian businesses to adopt online payment functionality. Nearly eight in ten Canadians shop online, according to Statistics Canada. To capture your share of this growing market, your business may want to develop online payment capabilities. In this article, we’ll explain why you should consider taking online payments and provide a primer for how to do so.

The benefits of taking online payments

To justify the effort and expense of adding online payment capabilities to your business, it helps to understand why it’s important. You may see the following advantages.

Increase your revenue base by capturing online shoppers.

While your business values in-person sales at your stores, adding online shopping is one of the quickest ways to increase revenue. Every month, Canadian retail businesses make around 4.3 million e-commerce sales.

If your business doesn't have a way to capture online consumers, you’ll miss out on a valuable source of revenue and growth. About 5.7% of Canadian retail purchases (PDF) are e-commerce, and 57% of Canadian consumers make an online purchase during a given month. What's your business strategy to meet customers where and how they want to shop?

Reach an international audience.

In addition to expanding your reach with a local audience, adding online payments and e-commerce to your business can help you reach an international audience. Customers from around the world can browse and purchase your goods and services using online payment options. Language doesn’t need to be a barrier. Web browser tools can translate your website to make it easier for people in other countries to purchase. Make sure you understand how tariffs, which are taxes or duties imposed on imports, may impact your e-commerce sales in different countries.

Allow customers to pay with digital wallets.

Adding online payments to your business isn't just about shopping through your website. Today's consumers increasingly use their phones to make payments with digital wallets such as Google Pay™.

Digital payments make up 69% of Canada’s payment transaction volume (PDF). The same percentage of consumers (69%) use contactless payment methods in grocery stores. Customers clearly want digital payment options. Companies may appeal to a wider base of consumers by working with a payment processor that supports digital wallets and other contactless payments.

Increase your revenue base.

Every month, Canadian retail businesses report around 4.3 million ecommerce sales. About 5.7% of Canadian retail purchases are e-commerce, and 57% of Canadian consumers make an online purchase during a given month.

Reach international customers

Customers from around the world can browse and purchase your goods and services using online payment options.

Allow customers to pay with digital wallets.

Consumers increasingly want to use their phones to make mobile payments on apps such as Google Pay™.

Accept payments after hours.

Companies that sell physical products can fulfill orders that arrive after hours when business opens the next day. Companies that sell digital products can receive and fulfill orders 24 hours a day, 7 days a week.

Sources:

Receive payments online and grow your sales outside normal business hours.

Most small businesses don’t operate 24 hours a day. Smart business owners know they shouldn't remain open when the costs to operate exceed the revenue they expect to receive.

However, when you're closed, you still lose out on revenue. With online payments, your overhead costs are low and your income potential is unlimited. Companies that sell physical products can fulfill orders when the business opens the next day. Companies that sell digital products can receive and fulfill orders 24 hours a day, seven days a week.

Components in the payment process

Setting up your business for online payments involves several key components. Here are a few helpful elements to understand if you accept online payments.

Payment processor

A payment processor manages the transfer of credit card information from the merchant to the payment networks and banks involved in the transaction.

Payment network

The association that sets the fees for credit cards, decides where they can be used, processes transactions, and helps facilitate payments. They serve as a bridge between merchants and the banks that issue credit cards. Payment networks include Visa®, Mastercard®, American Express®, and Discover®.

Card issuer

The financial institution, for instance the bank or credit union, that issued the credit card.

How online credit card transactions work

When a customer uses a credit card to make an online payment to your business, the process works as follows:

- A customer provides their payment details and clicks submit.

- The payment processor electronically accesses many of the payment networks (for instance, Visa®, Discover®, and Mastercard®) for authorization and capture.

- The payment processor conveys the transaction to other payment networks (for instance, American Express®) for settlement directly with the merchant.

- The payment processor forwards bankcard transactions for clearing with Visa®, Discover®, and Mastercard®.

- The payment processor sends a debit of the transaction amount to the card issuer.

- The card issuer bills the cardholder for the amount of the transaction.

- The card issuer pays the payment processor for the transaction minus the interchange fees, which go to the card issuer.

- The merchant receives credit for the transaction minus the processing fees.

Online payments involve several key components, including:

Payment processor:

A company that manages the transfer of credit card information from the merchant to the payment networks and banks involved in the transaction.

Payment network:

These networks include Visa®, Mastercard®, American Express®, and Discover®.

Card issuer:

The financial institution, for instance the bank or credit union, that issued the credit card.

The process:

Sources:

- A customer provides their payment details and clicks submit.

- The payment processor electronically accesses many of the payment networks (for instance, Visa®, Discover®, and Mastercard®) for authorization and capture.

- The payment processor conveys the transaction to other payment networks (for instance, American Express®) for settlement directly with the merchant.

- The payment processor forwards bankcard transactions for clearing with Visa®, Discover®, and Mastercard®.

- The payment processor sends a debit of the transaction amount to the card issuer.

- The card issuer bills the cardholder for the amount of the transaction.

- The card issuer pays the payment processor for the transaction minus the interchange fees.

- The merchant receives credit for the transaction minus the processing fees.

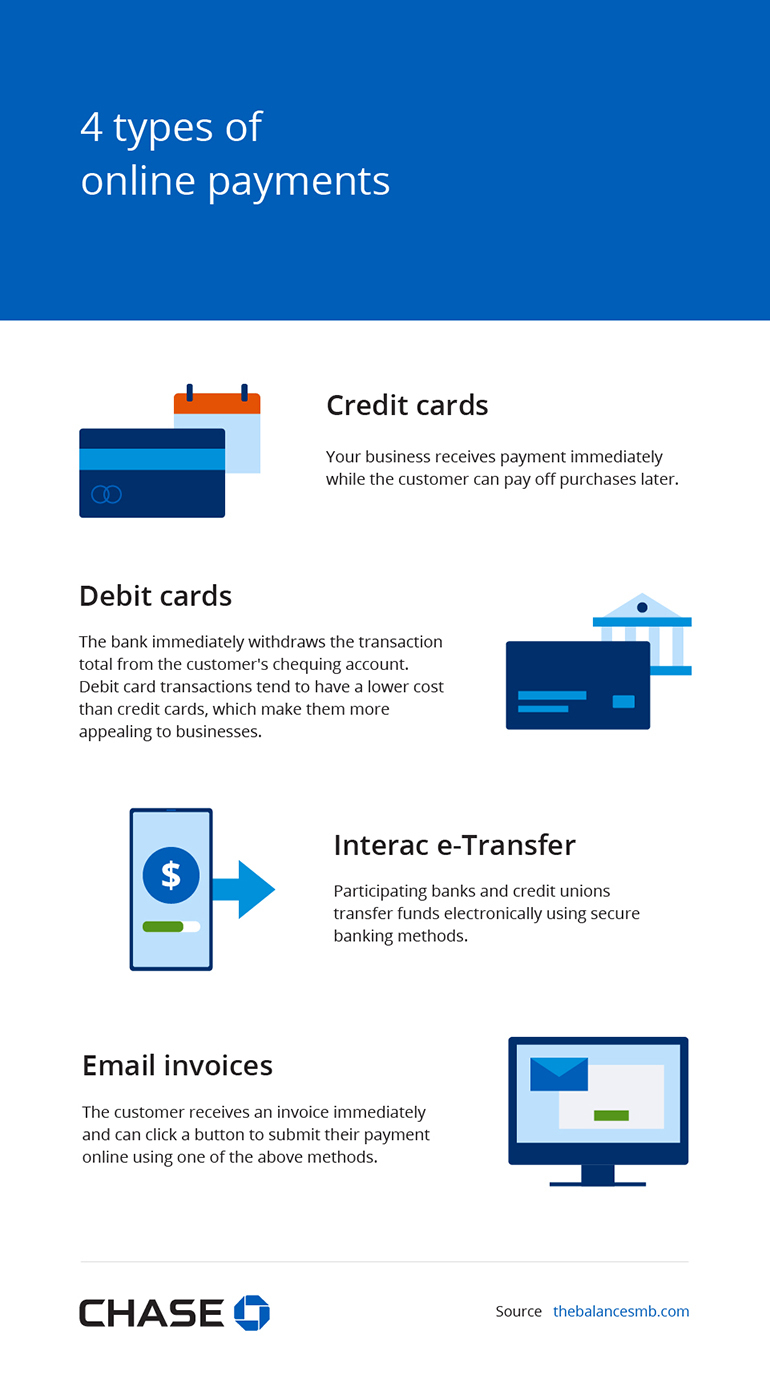

Different types of online payments

Common forms of online payments available for your business include the following.

Credit cards

Customers use a credit card to make purchases up to their available credit limit. Your business receives payment immediately, and the customer pays off purchases later. If the customer doesn’t pay the balance by their due date, the card issuer charges interest.

Debit cards

Consumers can use most debit cards as credit cards. However, debit card transactions tend to have a lower cost than credit cards, which makes them more appealing to businesses. Unlike a credit card, the bank immediately withdraws the transaction total from the customer's chequing account.

Interac e-Transfer

This Canadian payment method offers a way to send money using online banking. Participating banks and credit unions transfer funds electronically using secure banking methods.

Email invoices

Email invoices are digital versions of the traditional invoices a vendor mails to a customer. By emailing the invoice, the customer receives it faster, and they can click a button to submit their payment online.

Credit cards

Your business receives payment immediately while the customer can pay off purchases later.

Debit cards

The bank immediately withdraws the transaction total from the customer's chequing account. Debit card transactions tend to have a lower cost than credit cards, which makes them more appealing to businesses.

Interac e-Transfer

Participating banks and credit unions transfer funds electronically using secure banking methods.

Email invoices

The customer receives an invoice immediately and can click a button to submit their payment online using one of the above methods.

What to look for in a payment processing vendor

When choosing a payment processing platform, you want a trusted partner that makes your business more efficient and helps increase revenue and profitability. Look for a reliable payment processor that:

- Offers flexible processing options

- Accepts all major credit cards and contactless payment

- Works with many popular shopping cart software programs

- Uses fraud and encryption tools to protect customers and businesses

- Offers online reports to provide information about payments

- Provides 24/7 customer service support

- Has transparent pricing and doesn’t charge hidden fees

- Can help grow your business globally

The bottom line

By adding online payments to your business, you can increase revenue, expand your customer base, and streamline your operations. Customers increasingly use online and mobile payments to make purchases easier. Businesses that don't offer the payment options customers are looking for may miss out on additional revenue. Once you implement your online payment solution, it will offer a return on investment that quickly pays for itself.