How to future-proof your retail POS system

By Abby Quillen

Change is the only constant in the retail world, and your business needs to be ready for it. Case in point: Canadian retail sales have fluctuated consistently for the past 10 years, sometimes with notable variations from month to month due to economic trends and other events. The good news? No matter what lies ahead, a future-proofed point-of-sale (POS) system can help your business stay resilient.

Future-proofed POS systems accommodate new features, integrations, and advancements and can reliably scale with your business as it grows and evolves. Plus, they enable real-time data analysis to help your business quickly adjust to market conditions. Ready to choose a POS system for retail that’s built for the long term? Here’s what you need to know to choose future-proofed POS hardware and software.

Different types of POS systems for retail

Before we discuss how to choose future-proofed POS hardware, let’s review the most common types.

Terminal

These robust devices are specifically designed to process sales transactions and provide a central hub for all types of retail sales. Traditionally, POS terminals were stationary devices installed in fixed locations, but today, they can be handheld and mobile. Many terminals come with built-in peripheral hardware, such as employee- and customer-facing displays, a barcode scanner, a cash drawer, a card reader, and a receipt printer.

Mobile

Mobile POS systems are smartphones or tablets converted into modern POS systems with the installation of software and a plug-in credit card reader. These systems can usually integrate with barcode scanners or receipt printers if needed. Mobile POS systems are affordable and easy-to-use solutions. They can work well for small retail stores that need to ring up sales on the sales floor or at events. Apple’s Tap to Pay on iPhone, for example, operates without any extra terminals or hardware. However, mobile POS features may be too limited for larger operations.

Self-service kiosk

These POS systems allow customers to scan and pay for their own products. They often include a display, card reader, barcode scanner, and receipt printer. Self-service kiosks are popular in grocery stores and other retail stores. In the 2024 State of Canadian Payments, 41% of Canadian businesses desired to offer virtual kiosks, which provide self-service payments and other AI-powered solutions. However, it’s worth noting that some major Canadian retailers have recently moved away from self-checkout to deter theft.

Desktop or laptop

These POS systems run on personal desktops or laptops, making them versatile choices for smaller operations. Like mobile POS systems, they usually integrate with barcode scanners or receipt printers if needed.

- Terminal POS systems

Robust devices specifically designed for payment transactions - Mobile POS systems

Smartphones or tablets running POS software and outfitted with mobile card readers - Self-service kiosks

All-in-one POS systems that allow customers to scan and pay for goods on their own - Desktop

A personal computer or laptop running POS software, often integrated with a cash drawer, card reader, scanner, and receipt printer

Source:

How to choose future-proofed POS hardware

Consider these factors when investing in POS hardware built for the long term.

Durability

Choosing well-built, reliable hardware saves you both time and money. No matter how busy your retail operation is now, look for hardware that can withstand the nearly constant use that’s typical in a busy retail environment. Also, consider the battery life of wireless, handheld terminals. Ideally, they should be able to handle up to 1,000 transactions on a single charge.

Reliability and scalability

Even if you have just one small shop today, your hardware should be able to support multi-terminal and multi-location businesses so you don’t have to switch as you scale. Your hardware should also be able to handle high-volume periods like peak hours and holidays.

Upgradeable components

Look for hardware with upgradeable components, like memory, storage, and processing power so it can adapt with your business. Consider also opting for hardware with multiple connectivity options, like Ethernet, Wi-Fi, and Bluetooth® that also boasts USB ports so your POS system can function if one connection type fails.

- Durability

Choose a system with great battery life and the durability to withstand near-constant use. - Reliability and scalability

Invest in a POS system that supports multi-terminal and multi-location businesses so you don’t have to switch as you scale. Your hardware should also be able to handle high-volume periods like peak hours and holidays. - Upgradeable components

Look for a system that allows you to expand memory, storage, and processing power whenever you want. Ideally, it should also have multiple connectivity options, such as Ethernet, Wi-Fi, and Bluetooth® and feature USB ports.

Sources:

How to choose POS software for retail stores

Software is the central core of your POS system. It allows you to upload your catalogue and process sales. Plus, it provides tools for sales reporting, inventory management, employee management, customer relationship management, and more. As with hardware, you’ll need to ensure your software is always up to date. Consider these factors when comparing POS software.

All-in-one vs. modular

All-in-one POS systems (sometimes called integrated POS systems) are complete solutions, meaning the hardware, software, and peripherals come together. These systems are often easier to set up and usually offer employees and customers an efficient, convenient, and user-friendly experience. If you opt for an all-in-one system, you’ll be locked into the company’s ecosystem, so look for a trusted company with experience and expertise in the industry.

Modular systems allow you to independently choose hardware, software, and a payment processor. These systems are more complicated to set up but offer customization and flexibility. They may be the right solution for larger merchants, enterprise companies, and retailers operating in emerging markets. You can usually switch out components as your business grows. Plus, modular system providers often offer dedicated experts to tailor payment solutions to your needs. If you opt for a modular system, make sure components seamlessly integrate with each other.

Cloud-based vs. server storage vs. hybrid

Most modern POS systems are cloud-based. That means they store data online so you can access it anytime, anywhere, as long as you have an Internet connection. These systems provide a high level of flexibility and accessibility — and they can grow with your business. The downside? Your POS system will go down during Internet outages.

Server POS systems store your data in a local server. These systems tend to be more expensive, and they can become outdated and expensive to maintain.

Hybrid systems are a third option worth considering. They offer cloud-based storage with local server backup, providing the benefits of both types of storage.

Automatic updates

Outdated POS software can expose your company to cyberattacks or system failure, so regular software updates are critical for future-proofing your POS system. Updates add new features, provide security patches, and revise compliance requirements. Ideally, look for software that allows you to set automatic updates during low-traffic hours. If the software doesn’t feature automatic updates, make sure you’ll at least get notifications when updates are available.

The importance of security in retail POS systems

No matter which hardware and software you select, secure payment processing and data protection are critical in the retail space. These strategies can help you comply with industry standards and regulations to keep your business and customers safe for the long term.

EMV chip card compliance

Retail businesses are at risk for payment fraud, point-of-sale tampering, stolen credit cards, and other common forms of fraud. EMV chip card compliance helps protect your business against fraud by supporting secure chip-card technology. While fraudsters could easily counterfeit magnetic stripe card data, chip cards generate a new code for each transaction, making credit card payments more secure.

Online fraud prevention

From 2019 to 2022, the number of fraudulent consumer transactions originating from Canada increased from 2% to 3%, according to a 2023 TransUnion analysis. Visa®, Mastercard®, Discover®, and American Express® offer Address Verification System and other checks during online transaction processing to help your business detect potential fraud. Understanding these helpful services can help you decline potentially fraudulent orders.

Privacy regulation compliance

If you collect private consumer data, you must also understand the risk of data breaches and take steps to protect sensitive information. Your POS system must comply with industry standards for privacy. These standards include the Payment Card Industry Data Security Standard (PCI-DSS), which protects cardholder data during transactions, and the Personal Information Protection and Electronic Documents Act (PIPEDA), which safeguards consumer privacy and data-handling practices. Retail operations in Alberta, British Columbia, and Quebec are generally exempt from PIPEDA because they must comply with provincial consumer privacy laws.

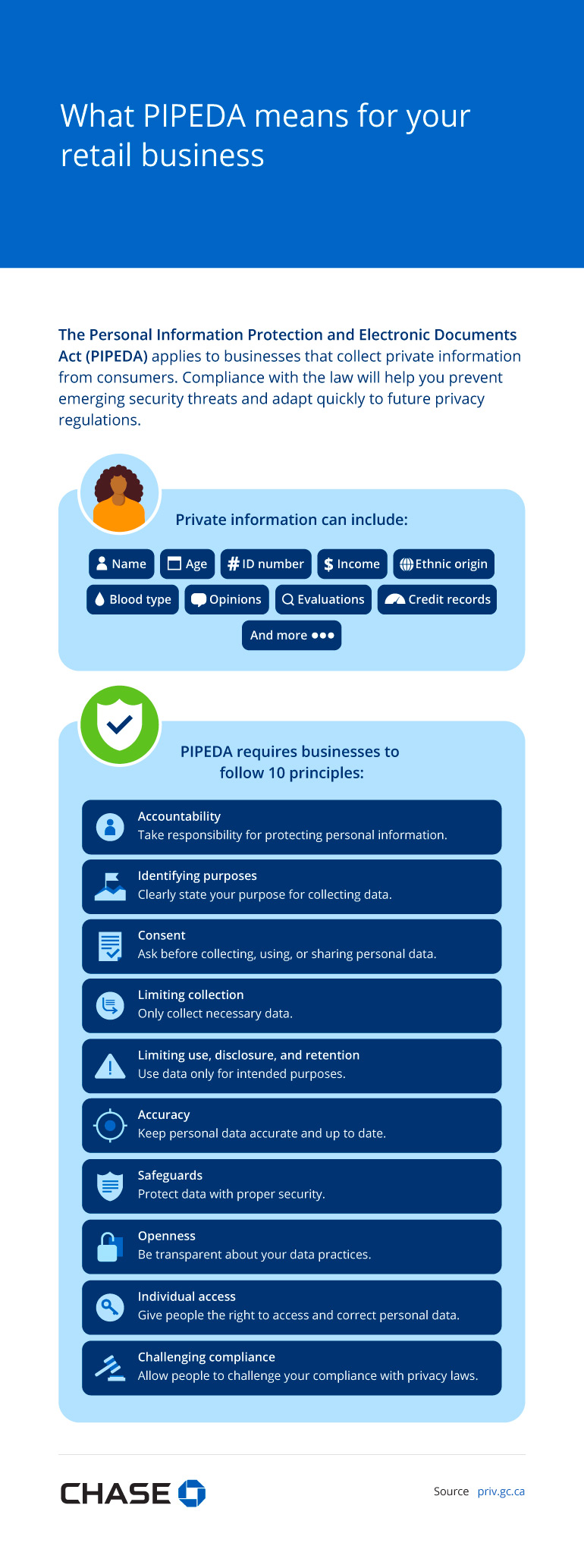

The Personal Information Protection and Electronic Documents Act (PIPEDA) applies to businesses that collect private information from consumers. Compliance with the law will help you prevent emerging security threats and adapt quickly to future privacy regulations.

Private information can include:

- Name

- Age

- ID number

- Income

- Ethnic origin

- Blood type

- Opinions

- Evaluations

- Credit records

- And more

PIPEDA requires businesses to follow 10 principles:

- Accountability: Take responsibility for protecting personal information.

- Identifying purposes: Clearly state your purpose for collecting data.

- Consent: Ask before collecting, using, or sharing personal data.

- Limiting collection: Only collect necessary data.

- Limiting use, disclosure, and retention: Use data only for intended purposes.

- Accuracy: Keep personal data accurate and up to date.

- Safeguards: Protect data with proper security.

- Openness: Be transparent about your data practices.

- Individual access: Give people the right to access and correct personal data.

- Challenging compliance: Allow people to challenge your compliance with privacy laws.

Source:

Conclusion

No one knows the future, but retail businesses can expect technological leaps, market fluctuations, and industry shifts. A future-proofed, secure retail POS system can help your business grow and thrive regardless of what happens. Look for durable, upgradeable hardware that integrates with essential components and secure software that receives regular updates. In addition, commit to staying compliant with security standards and privacy regulations to protect your business and consumers from cybercrimes and data breaches. By taking these steps and partnering with a reliable POS provider, your retail business will be ready for whatever the future brings. Contact us to learn more about choosing a flexible, future-ready POS system.