An Introduction to Bookkeeping and Accounting for Small Business Owners

By Jackie Lam

When it comes to the most exciting aspects of running your small business, financial housekeeping typically doesn't top the list.

And while you'd much rather be developing products or focusing on enhancing your services, making sure your bookkeeping and accounting are in order serves a purpose beyond preparing your financial records to file your business taxes with the Canada Revenue Agency (CRA). It also helps you keep an eye on cash flow, make good decisions for your company, and easily gather information to apply for financing.

The good news? Having a handle on your bookkeeping and accounting doesn’t have to be mired in challenges. Read this guide to learn how to help manage small business accounting and streamline your financial processes to ensure smooth operations.

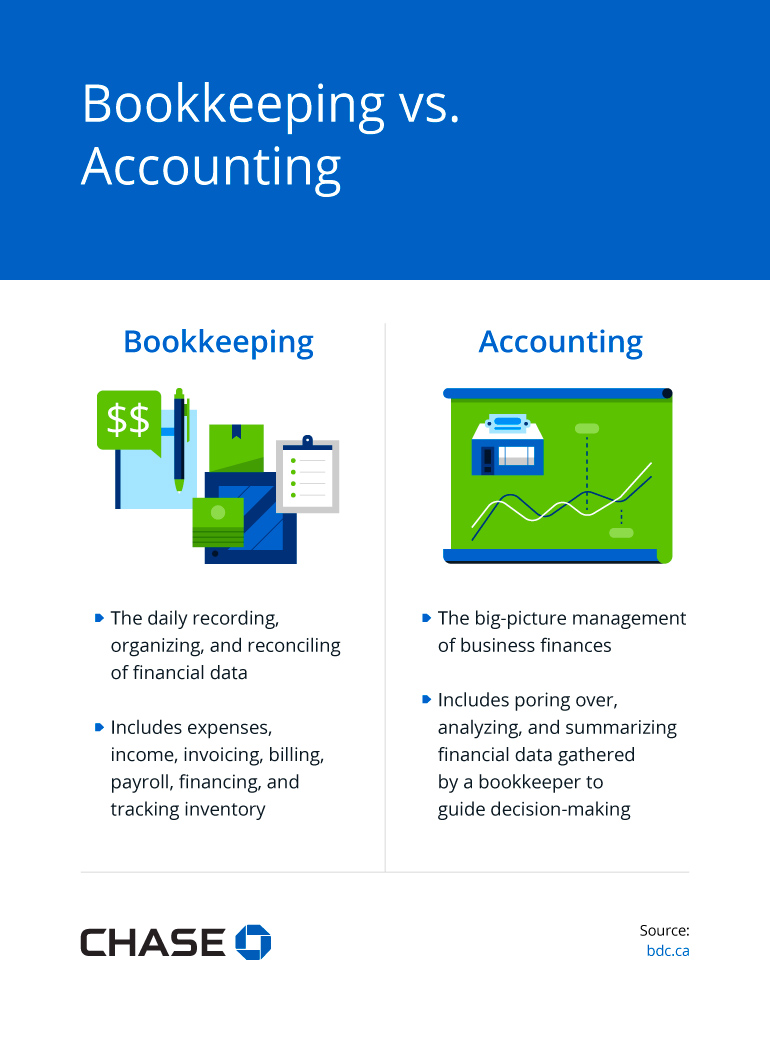

Bookkeeping vs. Accounting

People often conflate bookkeeping and accounting. It’s true that both relate to the financial aspects of your business, but they’re different.

Bookkeeping is the daily tracking of your financial data: think expenses, income, invoicing, billing, payroll, and financing such as business loans or business lines of credit. Bookkeeping also includes tracking your inventory and business assets.

You can think of bookkeeping as the recording, organizing, and reconciling of your financial information. It’s a part of accounting, which is the big-picture management of your business finances.

Accounting entails poring over the financial information gathered by a bookkeeper, analyzing it, and summarizing it. The purpose of accounting is to make sure your information is accurate, up to date, and reliable. That way, as a business owner, you can root business decisions in current financial data.

Bookkeeping

- The daily recording, organizing, and reconciling of financial data

- Includes expenses, income, invoicing, billing, payroll, financing, and tracking inventory

Accounting

- The big-picture management of business finances

- Includes poring over, analyzing, and summarizing financial data gathered by a bookkeeper to guide decision-making

Sources:

Establish Your Approach to Bookkeeping

Just like each painter has their preferred set of paintbrushes and approach to art-making, it's essential to come up with your approach to bookkeeping that's in line with your preferred way of doing things, as well as your business needs. Before you develop an approach for how to do bookkeeping for your small business, it helps to understand the basics.

Bookkeeping Basics

First, let's take a look at the five pillars of bookkeeping.

- Managing accounts

Generally, accounts cover the broad categories of assets, liabilities, income, expenses, and equity. These accounts are represented by ledger pages, which we'll get into next.

- Maintaining the general ledger

A general ledger categorizes the main types of your business's financial transactions, including:

- Revenue

- Expenses

- Transfers

- Keeping a record of transactions

Bookkeepers usually need to track these common transactions:

- Sales of products, payment for services rendered, and other sales income

- Expenses

- Asset purchases

- Loan and lease payments

- Investments

- Payment processing statements

- Reviewing processes

Evaluating your processes helps you devise systems and workflows to increase efficiency. The more efficient your processes, the more time, energy, and money you can save. Some methods you may want to review regularly include:

- Chart of accounts

- Bookkeeping entries

- Billing

- Financial statements (e.g., profit and loss, income statement)

- Processes to file tax returns

- Planning for the future

As your small business is constantly evolving, make sure you have the tools and systems in place to scale. Questions to ask yourself may include:

- Is there any system or process that I can improve?

- What financial information and reports do I have access to? Am I making the most of these reports?

- Are the bookkeeping and accounting software and programs I'm using a good fit for my current and future needs?

- Am I making the most of the information provided by my point-of-sale (POS) system? A POS system can help streamline and simplify your bookkeeping and accounting processes because it records each transaction and generates sales reports.

- Manage accounts to monitor assets, liabilities, income, expenses, and equity.

- Maintain the ledger to organize revenue, expenses, and transfers.

- Record transactions including purchases, payments, and investments.

- Review processes to boost efficiency.

- Plan for the future using insights from your point-of-sale system.

Small Business Receipts

Many new business owners wonder how to file receipts for small businesses. While you don’t need to file your receipts with your taxes, it’s important to hold onto them in case of an audit because they confirm the entries in your books and your tax returns.

While other information — billing, invoicing, and credit card and bank statements — can also verify your financial transactions, keeping a record of your receipts is helpful. You don't necessarily need to hold onto physical copies. Snapping a photo or scanning receipts usually suffices.

Typically, you'll want to keep receipts and documents of the following types of purchases:

- Business-related supplies, software, and equipment

- Business travel expenses

- Business meals and entertainment

- Gas and car maintenance

- Confirmation of payment for professional services (e.g., legal, financial, consulting)

- Cancelled cheques

It's a good rule of thumb to hold onto receipts from at least the last four tax years. The CRA can perform an audit three years from the time they initially reviewed your T1 or T2 tax return.

Small Business Accounting Basics

As we talked about earlier, bookkeeping is related to and helps support accounting. Without accurate, consistent bookkeeping, you won't be able to do your accounting in an efficient, timely manner.

The goal of bookkeeping is to maintain accurate entries. The goal of accounting, on the other hand, goes beyond summarizing your financial data to analyzing the data to make informed decisions about your business.

As your business grows, your accounting needs may also change. You may need to progress beyond simple bookkeeping and accounting to more engaged, complex, and sophisticated systems.

To learn how to keep accounting records for small businesses, it’s important to first understand the basics, including banking, payroll, and taxes.

Your Small Business Bank Account

Even if you're just starting, it's a good idea to have a small business account for your banking needs. A business account keeps your personal and company transactions separate, which reduces confusion, errors, and time spent categorizing expenses. Plus, it can help your business establish credibility, especially in your company's early stages.

Along the same lines, consider getting a business credit card to help keep your business-related purchases separate and simplify your payments. When you have to make only one payment a month to your credit card instead of several payments throughout the month, cash flow is simpler. Plus, you may be able to take advantage of credit card perks and points.

Payment and Payroll

Another consideration is how you pay your vendors and how you receive payment. If you're a product-based small business, it’s important to think about what you need to track in terms of what comes in (accounts receivable) and what goes out (accounts payable). And you should think about the best way to create systems and categorize your transactions.

If you have employees, you'll also need to set up payroll. Payroll involves figuring out each employee's pay and subtracting taxes, retirement contributions, insurance, and other benefits. You need to track any transactions relating to your payroll. Typically, you can integrate your accounting software, such as QuickBooks, right into your point-of-sale (POS) system.

Taxes by Business Type

Now, let's take a look at the three main business structures for Canadian businesses.

Sole proprietorship. The most common and simplest business structure, a sole proprietorship is a business owned by one individual. As far as taxes go, you pay personal income tax on income earned through your company. You also pay taxes by reporting income or loss on a T1 return.

Partnership. In a nutshell, a partnership is a business relationship between at least two partners. Each partner gets a share of business profits or losses. In terms of taxes, the partnership itself doesn't file a tax return.

The parties report any income or loss from the partnership on either a personal, corporate, or trust income tax return. Each partner may also need to file financial statements depending on their situation.

Corporation. Sole proprietorships and partnerships aren't treated like separate legal entities from their owners, but a corporation is. In the way of taxation, the corporation pays taxes separately from taxes the shareholders and directors pay. Corporations are also subject to corporation tax rates.

Just starting a small business?

You need to understand these accounting basics.

- Banking

Consider opening a designated business bank account and getting a business credit card to make accounting easier.

- Payments and payroll

Research and design a system to track accounts payable and accounts receivable.

If you have employees, you’ll need to set up a payment system, which involves figuring out employee pay and subtracting taxes, retirement contributions, insurance, and other benefits.

- Business structure

Each company setup has different tax implications. Research to determine whether a sole proprietorship, partnership, or corporation makes the most sense for your business.

Sources:

Finding Support

You aren't alone when it comes to tending to your accounting and bookkeeping needs. Depending on your situation and needs, you may benefit from working with an accountant, chartered professional accountant (CPA), or tax professional.

Grow Your Business

Knowing the difference between bookkeeping and accounting, the basics of both, and how to create systems, processes, and workflows to maintain accurate records can help save you time, energy, and costs. It’s a good idea to integrate your payment processing and accounting software to improve efficiency and accuracy. Keeping good financial records helps you make informed, data-based decisions so your small business grows and thrives.