Why you should be interested in new payment trends

While adding new payment methods might have been seen as tedious, time-consuming, and expensive in the past, interest in digital payment methods and usage among consumers and businesses have now accelerated.

In fact, our 2024 State of Canadian Payments report found that 71% of payment processing decision-makers said offering the latest innovations in payment processing services was a way to differentiate from competitors. The same percentage of respondents said their customers expected them to offer the very latest in payment tech.

Other research shares similar findings. For starters, a recent report by Payments Canada (PDF), found that Canadians are embracing innovations in the digital payment space. Plus, a report by Statistics Canada revealed that businesses planned to accept more digital and contactless payments in the next 12 months.

Canada’s recent Consumer-Driven Banking Act, overseen by the Financial Consumer Agency of Canada (FCAC), lays the groundwork for further advancements in the financial services landscape. The FCAC says they are pursuing a consumer-driven framework that prioritizes innovation and allows consumers to better manage their finances — and financial outcomes — with the latest secure, data-driven financial and banking services.

According to the Government of Canada, establishing this framework presents many benefits for consumers, businesses, and the Canadian economy. For starters, consumers would gain enhanced data security and protections for the digital economy while businesses benefit from improved efficiency and reduced administrative burden. At the same time, the implementation of consumer-driven banking is poised to strengthen the Canadian economy and boost international competitiveness.

The rise of contactless card payments and digital wallets is just the beginning. In this article, we'll take a look at emerging payment technology innovations.

According to Technology Strategies International Inc.’s Canadian Payments Forecast 2024:

- The number of contactless payments in Canada increased by 17% in 2023 to reach 63% of all in-store payments.

- The value of contactless payments increased by more than $80 billion over the year, which represents a year-over-year growth of 20%.

- The number of in-store mobile transactions has grown by 42% over the year and now represents about 23% of all contactless transactions.

Source:

The efficiency of self-checkout kiosks.

You're likely already familiar with self-checkout kiosks. In a nutshell, consumers can use these self-payment stations to scan and pay for goods and services without any interaction with a cashier. Self-checkout kiosks can integrate with new payment technologies such as digital wallets and built-in virtual keyboards.

Self-checkout kiosks can enhance the customer experience by cutting down on wait times and providing privacy. Another benefit of self-checkout kiosks is that customers can feel more secure by paying on their own rather than handing over a card to a restaurant server, for instance.

For business owners, self-checkout kiosks offer flexibility and reduced labour costs. They can also help businesses gain valuable insights by providing helpful data on customer preferences. To make the most of self-checkout kiosks, consider strategically placing them in high-traffic areas or near the traditional checkout location.

The trend toward self-checkout kiosks has accelerated in recent years. North America was the largest region in the self-service kiosk market share in 2023, according to the Self-Service Kiosk Global Market Report 2024 from Global Information, Inc.

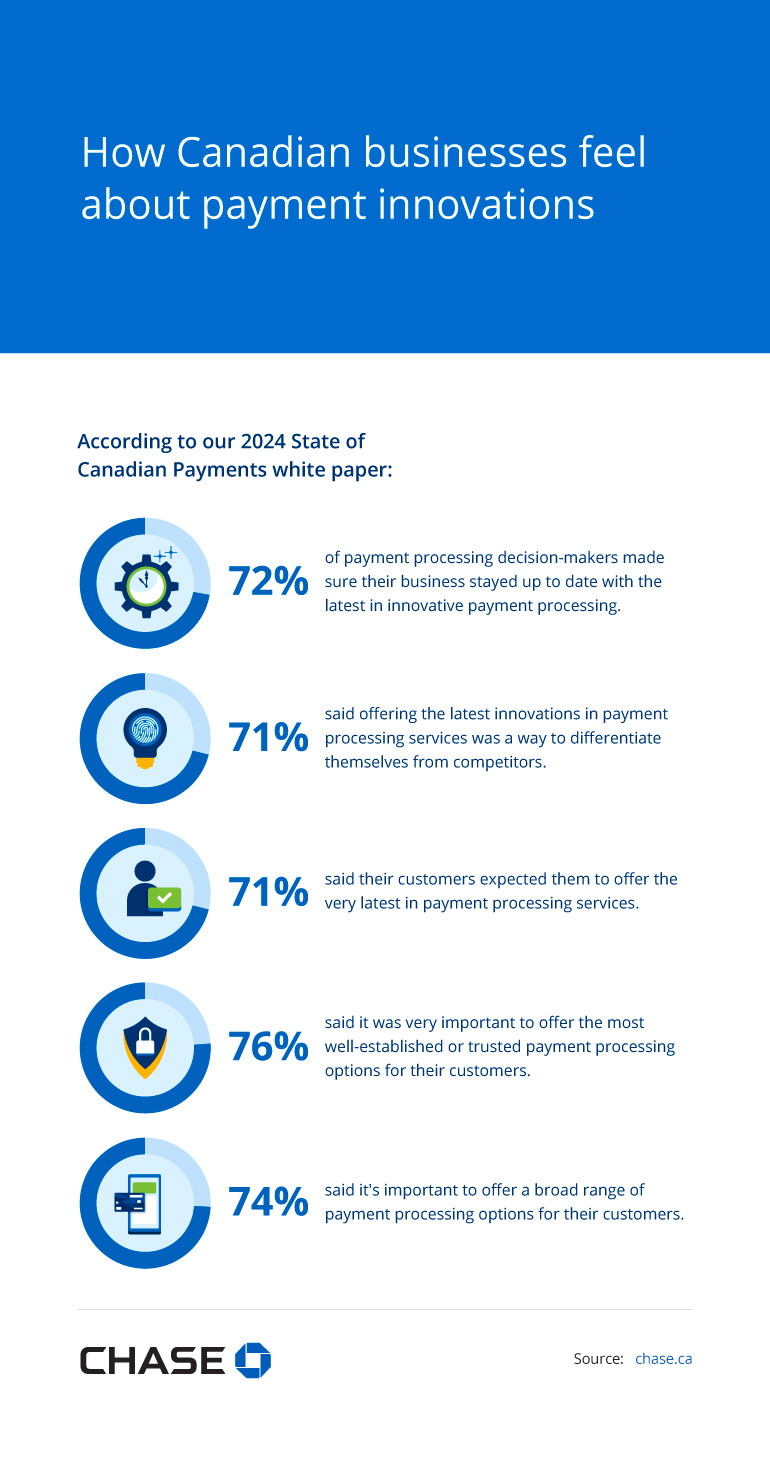

According to our 2024 State of Canadian Payments white paper:

- 72% of payment processing decision-makers made sure their business stayed up to date with the latest in innovative payment processing.

- 71% said offering the latest innovations in payment processing services was a way to differentiate themselves from competitors.

- 71% said their customers expected them to offer the very latest in payment processing services.

- 76% said it was very important to offer the most well-established or trusted payment processing options for their customers.

- 74% said it's important to offer a broad range of payment processing options for their customers.

Source:

The convenience of digital wallets

Also known as a mobile wallet, a digital wallet is an app on your mobile phone or smartwatch that stores your payment information. You can think of this payment option as a digital version of a wallet that holds your credit, debit, and prepaid cards. A mobile wallet can also be used to store loyalty cards.

Managing multiple payment methods within a single app is convenient and efficient, and using a phone or watch to pay makes for a seamless, contactless checkout experience.

Digital wallets have also experienced a surge in adoption. The percentage of Canadian consumers who had used one increased from 38% in the second half of 2022 to 51% in the first half of 2023.

Top Drivers

- Improved security of payment transactions

- Increased customer satisfaction

- Cost savings through reduced operating costs, reduced vendor fees, etc.

- The ability to keep their business up to date with the industry standard in payment processing

Top Barriers

- Risk of fraud and non-payment

- Security risks

- Additional costs such as vendor fees and overhead

- Required employee training

Source:

The simplicity of wearable payments

As the name implies, wearable payments are a type of contactless payment made via a wearable device, such as a fitness tracker, smartwatch, ring, or keychain. Shoppers can tap or scan their wearable payment devices thanks to a linked debit or credit card. The devices themselves use near-field communication (NFC) or radio-frequency identification (RFID), which is the same technology used when a shopper initiates a contactless transaction by waving a card or digital wallet over a reader.

The benefits of wearable payments are many. They offer convenience, the ability for hands-free payment, and the choice to pay without lugging around a physical wallet with cards or cash. That’s what makes them such an appealing option for customers who engage in activities that would otherwise make carrying traditional payment methods more impractical and inconvenient. For example, wearables are great for commuters who want to quickly pay for their public transportation fare, runners who want to grab a coffee after they’ve logged their miles, or parents who may find it cumbersome to check out by card with young children in tow.

According to the Payments Canada report (PDF), 22% of total respondents said they were comfortable making a payment using a wearable device. That number jumped to 33% for the 18- to 34-year-old age group. And according to our State of Canadian Payments report, 42% of payment decision-makers surveyed said they desired to offer wearable payments.

Conclusion

The combination of innovative payment technology and its growing adoption among Canadian consumers means businesses who don’t embrace payment advancements may fall behind. But by staying up to date with industry news and exploring new options, businesses can offer consumers a flexible, seamless payments experience.

Check out our resource articles for more business and payment insights. Plus, don’t miss our analysis of insights from 2,200 Canadian business decision-makers in the 2024 State of Canadian Payments report. Contact us to explore tailored payment solutions for your business.