Winter tourism is coming: here’s how to prep your payment systems

By Kathryn Casna

Canada is a top destination for domestic and international winter travel, and why wouldn’t it be? The Great White North has everything from popular winter sports like skiing, snowshoeing, and snowmobiling to uniquely northern-hemisphere attractions like safaris to see polar bears and trips to see the northern lights. There are also festivals and fairs that bring visitors from near and far.

If your business depends on winter tourism to boost or supply most of your annual revenue, you’re not alone. One way to stand out from your competitors this season is to invest in robust payment technology and processes. Providing secure, fast, and convenient payment options can improve customer satisfaction and help you serve more customers in less time.

Mobile and connected payment systems can help you stay agile and organized no matter where business takes you.

The importance of winter tourism in Canada

Worldwide, tourism is on the rebound after a tough couple of years. In Canada, the number of active tourism businesses fell 8.8% (PDF) in 2020, the largest drop in any Canadian sector. Travel service businesses dropped more than 30%, and food and beverage, recreation and entertainment, transportation, and accommodation were also affected. Thankfully, tourism has recovered by leaps and bounds, with tourism spending reaching $113 billion in 2023, a figure that exceeds pre-pandemic records. And while inflation and high interest rates have put tourism at risk, the Canadian Tourism Data Collective reports that consumers continue to prioritize travel over other discretionary spending categories. The Data Collective projects that by 2030, total spending by tourists in Canada will reach $140 billion — an increase of 33% since 2019.

The Great White North has something for everyone.

- Winter sports in Canada include skiing, snowshoeing, snowmobiling, and hockey, just to name a few.

Visitors can also take excursions to see polar bears and the northern lights.

- Festivals and fairs are inviting, fun events for locals and tourists alike. Popular ones include:

- Ottawa’s Winterlude, with its National Ice-Carving Championship

- Yukon Rendezvous

- Québec Winter Carnival

- Tourism spending increased by 13.5% in 2023 after a 50.4% increase in 2022.

- As tourism continues to grow, small businesses that rely on winter tourism need to be ready with robust payment technology and processes.

Sources:

- Winterlude 2023 (2023, March 8). Government of Canada.

- Québec Winter Carnival. Carnaval de Québec.

- About Yukon Rendezvous. 2022 Yukon Rendezvous Festival.

- National tourism indicators, fourth quarter 2023 (2024, March 27). Statistics Canada.

- Revisiting Tourism: Canada’s Visitor Economy One Year into the Global Pandemic (2021, March). Destination Canada (PDF).

Tourism spending increased by 13.5% in 2023 after a 50.4% increase in 2022. This winter, Canadian small businesses can benefit from the growing number of tourists looking for a winter wonderland on their next holiday.

Make the most of the increase in tourism and capture business by streamlining your payment processing systems.

Offer contactless payment options

If you make most of your profits during the winter tourism season, take advantage of every opportunity to make a sale by catering to customers’ preferred payment methods. The majority of Canadians prefer to pay with a credit or debit card, and contactless payments have quickly become one of the most popular ways to pay for everything from restaurant bills to souvenirs to transportation. In fact, the volume of contactless payments in Canada increased by 17% in 2023 to reach 63% of all in-store payments.

There are multiple ways you can implement contactless payments.

Credit card tap readers

Your point-of-sale system should have a tap reader so you can take payments in a secure and popular way and encourage business. In 2020, both Mastercard® and Visa® increased their tap-to-pay limits in Canada, and that difference can really add up over the season.

Retail shops and restaurants where diners order and pay at the counter can benefit from having fast, convenient tap readers. Updated equipment can keep lines from growing while providing a great payment experience for your customers.

Mobile wallet payments

Canada hosts many popular winter festivals, including Ottawa’s Winterlude, the Québec Winter Carnival, and the Yukon Rendezvous. For small businesses, festivals mean lots of planning in preparation to serve a surge of visitors for just a few days. Taking payments efficiently is critical for maximizing your earnings and ensuring your hard work pays off.

Since 2020, 40% of Canadians have used mobile wallets more frequently to make purchases. And the wearable payments market is expected to grow by 29.8% from 2022 to 2028. On top of that, customers are spending more per transaction, too.

QR codes

A lesser-known contactless payment method is the use of quick response (QR) codes. These square, unique images turn a customer’s smartphone camera into a barcode reader. By scanning the QR code, your customers can quickly access a website that helps them start or complete their transactions. As the need and desire for contactless payments increased in 2020, more Canadian businesses offered QR-enabled payments.

Sit-down restaurants may benefit the most from this technology. In their simplest form, QR codes can be used to guide diners to digital menus, leaving them with one less item to touch during their meal. At their best, QR codes can guide customers to an e-commerce site where they can shop, order, and pay all in one contactless place. This method may shorten a server’s time at each table, allowing you to serve more customers amid potential staffing shortages.

The volume of contactless payments in Canada increased by 17% in 2023 to reach 63% of all in-store payments.

You can offer seamless credit card processing in a few ways.

- Credit card tap readers: Look for an icon that includes [icon] on the credit card terminal — which can be used with cards that have the same symbol.

- Mobile wallet payments

- QR codes

Source:

Stay connected for efficient payment processing

Contactless payment technology has the added benefit of speed, but it’s not the only way to increase efficiency. No matter how your customers pay, you need a strong Internet connection and cloud-based technology to process transactions.

Invest in high-speed Internet

By 2030, 100% of Canadians will have access to high-speed Internet. That’s good for your business because slow, unreliable connections can make it hard to process payments.

Internet comes in many forms. Fibre is the fastest, most reliable method, but most businesses do just fine with cable or even DSL connections for payment processing. Fixed wireless and satellite Internet can be less reliable, especially during winter storms, but in remote areas, they may be your only options. If your business provides remote excursions, encourage customers to pay ahead of time before leaving, or online through a website when booking. Also have a back-up plan for taking payments when you don’t have an Internet connection.

Use cloud-based payment processing software

With reliable, high-speed Internet, you can boost your efficiency further by investing in cloud-based payment processing software that helps your employees take payments on the go while aggregating data in one place. Businesses with multiple storefronts, for example, can sync inventory and sales automatically. Tour guides can add last-minute sightseers and capture upsells from anywhere they have cell service using a mobile card reader and an app on their smartphone or tablet.

Cloud-based software is also ideal for small businesses that need to make payments to their vendors on the go. For example, caterers and restaurateurs can quickly restock supplies for a festival booth or on-site event with ease.

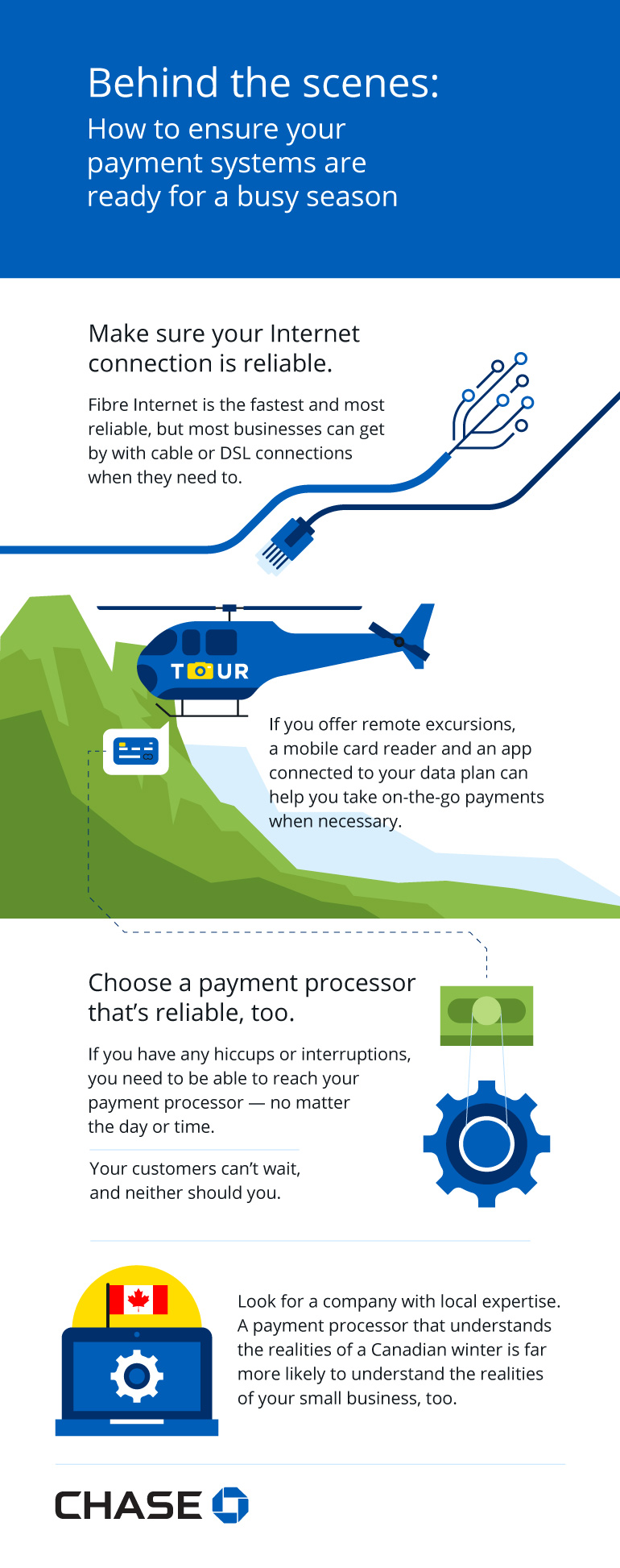

Make sure your internet connection is reliable.

- Fibre internet is the fastest and most reliable, but most businesses can get by with cable or DSL connections when they need to.

- If you offer remote excursions, a mobile card reader and an app connected to your data plan can help you take on-the-go payments when necessary.

Choose a payment processor that’s reliable, too.

- If you have any hiccups or interruptions, you need to be able to reach your payment processor — no matter the day or time.

- Your customers can’t wait, and neither should you.

- Look for a company with local expertise. A payment processor that understands the realities of a Canadian winter is far more likely to understand the realities of your small business, too.

Choose payment technology and processors you can trust

A Canadian winter is unpredictable, and your payment technology and processes need to be able to carry your small business through a busy season. Your payments provider needs to be an expert in Canadian small businesses and should be available to help your business when you need it. After all, if you can’t get immediate help from your processor, you could lose sales.

As you prepare for the next busy winter, ensure your payment technology and processes are reliable, secure, and ready to weather whatever happens. Winter tourism is critical for many Canadian small businesses, no matter if you serve travellers directly or support the businesses that do. Stay competitive this season with robust payment technology and processes, and you’ll have happier customers, a healthier bottom line, and improved success in the long run.